Anglo American PLC (AAL) - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00B1XZS820

Anglo American PLC, listed as LSE:AAL, is a prominent mining company based in the United Kingdom with a global presence. The company is dedicated to the exploration of various minerals including rough and polished diamonds, copper, platinum group metals, thermal coal, steelmaking coal, iron ore, nickel, polyhalite, and manganese ores, in addition to producing alloys.

Established in 1917, Anglo American PLC has solidified its position in the mining industry over the years. Their headquarters are situated in London, the heart of the United Kingdom. To learn more about their operations, you can visit their official website at https://www.angloamerican.com.

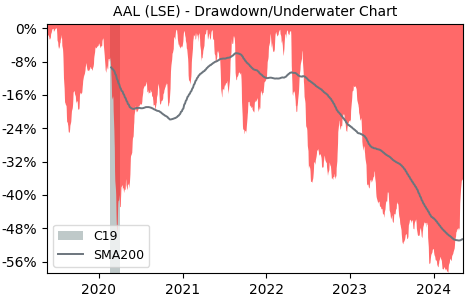

Drawdown (Underwater) Chart

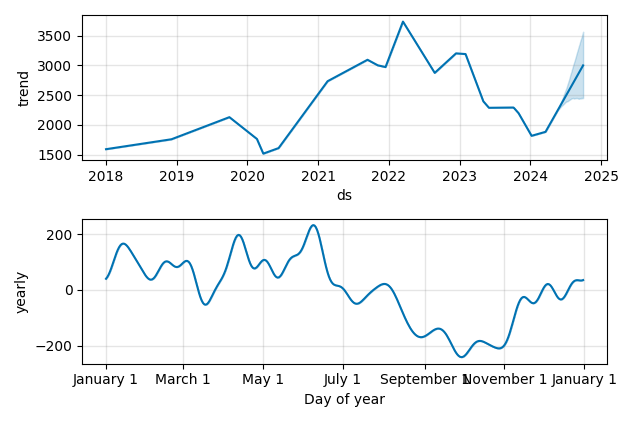

Overall Trend and Yearly Seasonality

AAL Stock Overview

| Market Cap in USD | 360m |

| Sector | Basic Materials |

| Industry | Other Industrial Metals & Mining |

| GiC SubIndustry | Diversified Metals & Mining |

| TER | 0.00% |

| IPO / Inception |

AAL Stock Ratings

| Growth 5y | 0.08 |

| Fundamental | 56.9 |

| Dividend | 6.02 |

| Rel. Performance vs Sector | -3.66 |

| Analysts | - |

| Fair Price Momentum | 1999.66 GBX |

| Fair Price DCF | 42.25 GBX |

AAL Dividends

| Yield 12m | 3.50% |

| Yield on Cost 5y | 3.86% |

| Dividends CAGR 5y | 2.68% |

| Payout Consistency | 75.5% |

AAL Growth Ratios

| Growth 12m | -9.10% |

| Growth Correlation 12m | -55% |

| Growth Correlation 3m | 53% |

| CAGR 5y | 1.99% |

| Sharpe Ratio 12m | -0.35 |

| Alpha vs SP500 12m | -37.53 |

| Beta vs SP500 5y weekly | 1.08 |

| ValueRay RSI | 83.43 |

| Volatility GJR Garch 1y | 40.24% |

| Price / SMA 50 | 14.67% |

| Price / SMA 200 | 7.94% |

| Current Volume | 6890.3k |

| Average Volume 20d | 5919.6k |

External Links for AAL Stock

What is the price of AAL stocks?

As of April 26, 2024, the stock is trading at GBX 2205.00 with a total of 6,890,312 shares traded.

Over the past week, the price has changed by +1.68%, over one month by +14.18%, over three months by +18.52% and over the past year by -12.18%.

As of April 26, 2024, the stock is trading at GBX 2205.00 with a total of 6,890,312 shares traded.

Over the past week, the price has changed by +1.68%, over one month by +14.18%, over three months by +18.52% and over the past year by -12.18%.

What is the forecast for AAL stock price target?

According to ValueRays Forecast Model, AAL Anglo American PLC will be worth about 2181.8 in April 2025. The stock is currently trading at 2205.00. This means that the stock has a potential downside of -1.05%.

According to ValueRays Forecast Model, AAL Anglo American PLC will be worth about 2181.8 in April 2025. The stock is currently trading at 2205.00. This means that the stock has a potential downside of -1.05%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 21.8 | -99.0 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 2181.8 | -1.05 |