Aston Martin Lagonda Global Holding.. (AML)

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00BN7CG237

Aston Martin Lagonda Global Holdings plc is a renowned company that specializes in designing, developing, manufacturing, and marketing luxury sports cars on a global scale. In addition to the sale of vehicles, they also offer the sale of parts, vehicle servicing, and engaging in brand and motorsport activities.

The company distributes its luxury vehicles through an extensive network of authorized dealers worldwide, ensuring accessibility and premium customer service. At the forefront of innovation, Aston Martin has a strategic technology partnership with Mercedes-Benz AG to enhance their product offerings.

Established in 2018, Aston Martin Lagonda Global Holdings plc is proudly headquartered in Gaydon, the United Kingdom, where they continue to set industry standards for excellence in luxury automotive craftsmanship. For more information, visit their official website at https://www.astonmartinlagonda.com.

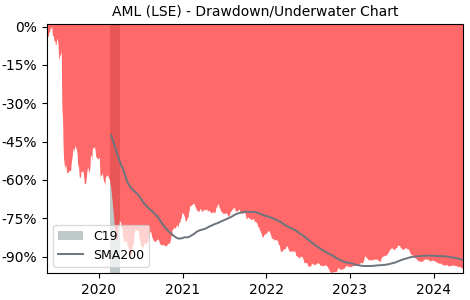

Drawdown (Underwater) Chart

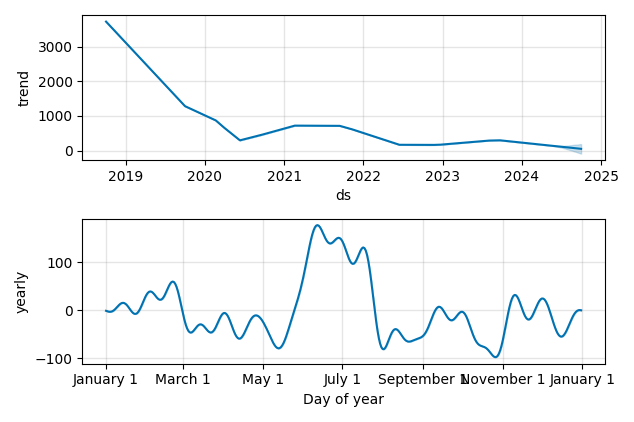

Overall Trend and Yearly Seasonality

AML Stock Overview

| Market Cap in USD | 17m |

| Sector | Consumer Cyclical |

| Industry | Auto Manufacturers |

| GiC SubIndustry | Automobile Manufacturers |

| TER | 0.00% |

| IPO / Inception |

AML Stock Ratings

| Growth 5y | -5.96 |

| Fundamental | -4.08 |

| Dividend | - |

| Rel. Performance vs Sector | -5.77 |

| Analysts | - |

| Fair Price Momentum | 101.14 GBX |

| Fair Price DCF | - |

AML Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

AML Growth Ratios

| Growth 12m | -35.19% |

| Growth Correlation 12m | -60% |

| Growth Correlation 3m | -60% |

| CAGR 5y | -41.82% |

| Sharpe Ratio 12m | -0.79 |

| Alpha vs SP500 12m | -66.85 |

| Beta vs SP500 5y weekly | 1.48 |

| ValueRay RSI | 25.43 |

| Volatility GJR Garch 1y | 48.67% |

| Price / SMA 50 | -9.59% |

| Price / SMA 200 | -37.19% |

| Current Volume | 1856.5k |

| Average Volume 20d | 1520.3k |

External Links for AML Stock

As of April 20, 2024, the stock is trading at GBX 151.00 with a total of 1,856,519 shares traded.

Over the past week, the price has changed by -4.04%, over one month by -9.74%, over three months by -20.18% and over the past year by -33.96%.

According to ValueRays Forecast Model, AML Aston Martin Lagonda Global Holding.. will be worth about 113.8 in April 2025. The stock is currently trading at 151.00. This means that the stock has a potential downside of -24.62%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 250.7 | 66.0% |

| Analysts Target Price | - | - |

| ValueRay Target Price | 113.8 | -24.6% |