Aviva PLC (AV) - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00BPQY8M80

Aviva PLC (LSE: AV) is a leading insurance and financial services company operating in the United Kingdom, Ireland, Canada, and globally, offering a wide range of products including insurance, retirement, investments, and savings.

The company provides a variety of services such as life insurance, long-term health and accident insurance, pension plans, annuities, and lifetime mortgages. It caters to individuals, small and medium-sized businesses, covering risks related to motor vehicles, medical expenses, property, liability, professional indemnity, and more.

Aviva also specializes in investment management services for pension funds and retail investment products like investment funds, unit trusts, and individual savings accounts. These services target institutional clients and individual investors alike, providing a diverse range of options to meet various financial needs.

Established in 1696 and headquartered in London, United Kingdom, Aviva PLC was formerly known as CGNU plc before rebranding in July 2002. The company reaches customers through insurance brokers and its MyAviva platform and continues to deliver innovative solutions to protect and grow the wealth of its clients.

For more information, visit their website at https://www.aviva.com.

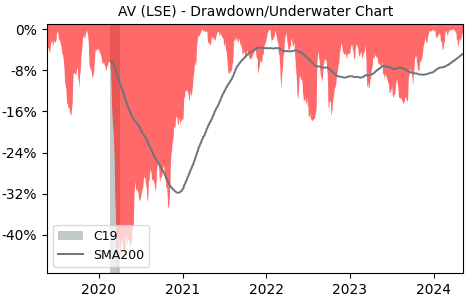

Drawdown (Underwater) Chart

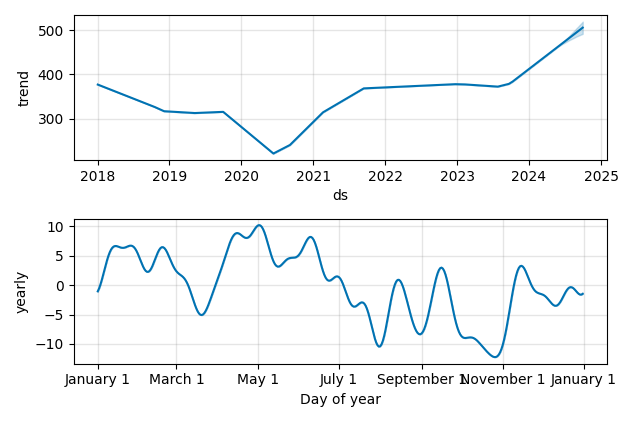

Overall Trend and Yearly Seasonality

AV Stock Overview

| Market Cap in USD | 156m |

| Sector | Financial Services |

| Industry | Insurance - Diversified |

| GiC SubIndustry | Multi-line Insurance |

| TER | 0.00% |

| IPO / Inception | 2009-10-20 |

AV Stock Ratings

| Growth 5y | 5.14 |

| Fundamental | -60.4 |

| Dividend | 7.20 |

| Rel. Performance vs Sector | -0.51 |

| Analysts | - |

| Fair Price Momentum | 435.95 GBX |

| Fair Price DCF | - |

AV Dividends

| Yield 12m | 7.10% |

| Yield on Cost 5y | 10.36% |

| Dividends CAGR 5y | 1.00% |

| Payout Consistency | 88.9% |

AV Growth Ratios

| Growth 12m | 21.35% |

| Growth Correlation 12m | 63% |

| Growth Correlation 3m | 66% |

| CAGR 5y | 7.83% |

| Sharpe Ratio 12m | 0.91 |

| Alpha vs SP500 12m | -4.70 |

| Beta vs SP500 5y weekly | 0.99 |

| ValueRay RSI | 71.73 |

| Volatility GJR Garch 1y | 20.50% |

| Price / SMA 50 | 5.1% |

| Price / SMA 200 | 17.36% |

| Current Volume | 7361.6k |

| Average Volume 20d | 11058.4k |

External Links for AV Stock

As of April 24, 2024, the stock is trading at GBX 470.70 with a total of 7,361,561 shares traded.

Over the past week, the price has changed by +4.05%, over one month by -0.27%, over three months by +13.84% and over the past year by +20.48%.

According to ValueRays Forecast Model, AV Aviva PLC will be worth about 500.9 in April 2025. The stock is currently trading at 470.70. This means that the stock has a potential upside of +6.42%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 500.2 | 6.27 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 500.9 | 6.42 |