Babcock International Group PLC (BAB)

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB0009697037

Babcock International Group PLC and its subsidiaries offer valuable services to the aerospace, defense, and security sectors across the United Kingdom, Europe, Africa, North America, Australasia, and beyond. The company operates across four main segments - Marine, Nuclear, Land, and Aviation. In these areas, they specialize in designing, procuring, operating, and managing critical utility and process equipment.

Within its services portfolio, Babcock provides asset management, defense and maritime training, intelligence services, equipment and system solutions, as well as facility and infrastructure management. They are also involved in naval platform development, manufacturing mechanical and electrical systems, and offering through-life support for various equipment.

Moreover, the company extends its expertise to areas such as naval architecture, engineering, and project management. Babcock is known for its submarine and complex engineering services, particularly in support of decommissioning programs and new build projects. Their services span across vehicle fleet management, military and civil equipment support and training, and vehicle design, manufacture, installation, and decommissioning for security organizations.

Babcock also offers track renewal and engineering services, specializing in track projects, signaling, telecommunications, and on-track plants. In addition, they provide essential engineering services to defense and civil customers, including pilot training, equipment support, airbase management, and emergency aviation services. The company, founded in 1891, is headquartered in London, United Kingdom. For more information, visit their website at https://www.babcockinternational.com.

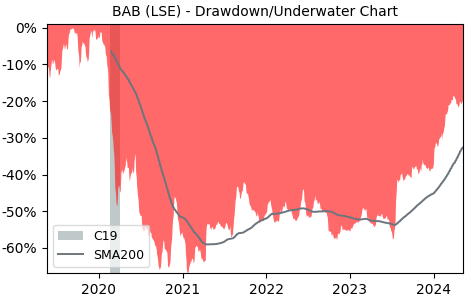

Drawdown (Underwater) Chart

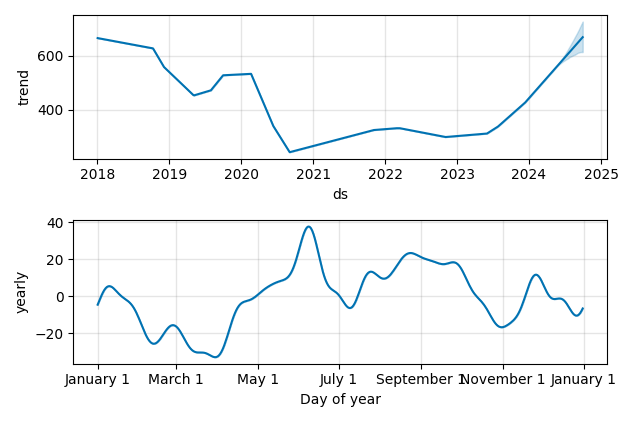

Overall Trend and Yearly Seasonality

BAB Stock Overview

| Market Cap in USD | 33m |

| Sector | Industrials |

| Industry | Engineering & Construction |

| GiC SubIndustry | Diversified Support Services |

| TER | 0.00% |

| IPO / Inception |

BAB Stock Ratings

| Growth 5y | 1.15 |

| Fundamental | 2.15 |

| Dividend | 1.65 |

| Rel. Performance vs Sector | 2.96 |

| Analysts | - |

| Fair Price Momentum | 508.60 GBX |

| Fair Price DCF | 9.83 GBX |

BAB Dividends

| Yield 12m | 0.34% |

| Yield on Cost 5y | 0.35% |

| Dividends CAGR 5y | -35.35% |

| Payout Consistency | 81.2% |

BAB Growth Ratios

| Growth 12m | 72.57% |

| Growth Correlation 12m | 77% |

| Growth Correlation 3m | 69% |

| CAGR 5y | 0.89% |

| Sharpe Ratio 12m | 2.01 |

| Alpha vs SP500 12m | 55.10 |

| Beta vs SP500 5y weekly | 0.70 |

| ValueRay RSI | 17.75 |

| Volatility GJR Garch 1y | 31.70% |

| Price / SMA 50 | 0.72% |

| Price / SMA 200 | 20.17% |

| Current Volume | 659.5k |

| Average Volume 20d | 1574k |

External Links for BAB Stock

As of April 19, 2024, the stock is trading at GBX 503.50 with a total of 659,463 shares traded.

Over the past week, the price has changed by -0.59%, over one month by -2.61%, over three months by +16.12% and over the past year by +70.59%.

According to ValueRays Forecast Model, BAB Babcock International Group PLC will be worth about 558.1 in April 2025. The stock is currently trading at 503.50. This means that the stock has a potential upside of +10.84%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 522.9 | 3.85% |

| Analysts Target Price | - | - |

| ValueRay Target Price | 558.1 | 10.8% |