Bellway PLC (BWY) - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB0000904986

Bellway PLC, listed on the London Stock Exchange under the symbol BWY, operates in the residential construction sector across the United Kingdom through its subsidiaries. Since its establishment in 1946, the company has been providing a wide range of housing solutions, from one-bedroom apartments to spacious six-bedroom family homes.

Aside from catering to individual buyers, Bellway PLC also collaborates with housing associations to offer homes for social housing purposes, contributing to the community and addressing the housing needs of different segments of society. The company markets its properties under distinctive brands like Bellway, Ashberry, and Bellway London, ensuring a diverse portfolio to suit various preferences and lifestyles.

Headquartered in the historic city of Newcastle upon Tyne in the UK, Bellway PLC continues to uphold its commitment to delivering quality homes and excellent customer service. To learn more about their projects and initiatives, you can visit their official website at https://www.bellwayplc.co.uk.

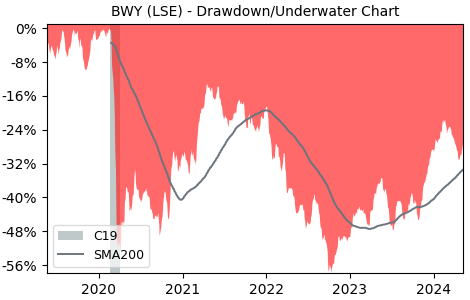

Drawdown (Underwater) Chart

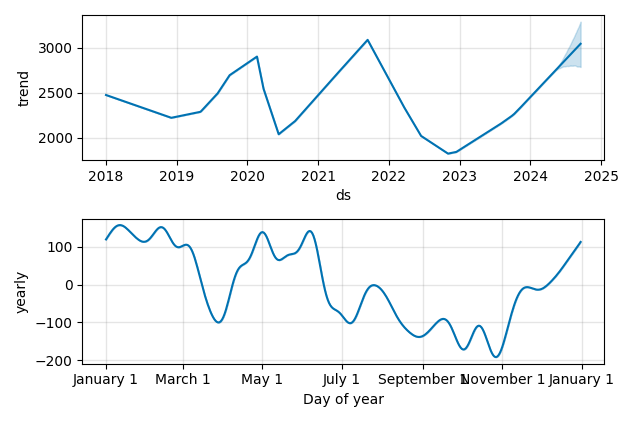

Overall Trend and Yearly Seasonality

BWY Stock Overview

| Market Cap in USD | 39m |

| Sector | Consumer Cyclical |

| Industry | Residential Construction |

| GiC SubIndustry | Homebuilding |

| TER | 0.00% |

| IPO / Inception |

BWY Stock Ratings

| Growth 5y | 0.18 |

| Fundamental | 60.7 |

| Dividend | 6.20 |

| Rel. Performance vs Sector | -2.97 |

| Analysts | - |

| Fair Price Momentum | 2274.29 GBX |

| Fair Price DCF | 57.61 GBX |

BWY Dividends

| Yield 12m | 5.63% |

| Yield on Cost 5y | 5.56% |

| Dividends CAGR 5y | -1.42% |

| Payout Consistency | 94.3% |

BWY Growth Ratios

| Growth 12m | 10.67% |

| Growth Correlation 12m | 50% |

| Growth Correlation 3m | -58% |

| CAGR 5y | -0.22% |

| Sharpe Ratio 12m | 0.21 |

| Alpha vs SP500 12m | -16.60 |

| Beta vs SP500 5y weekly | 1.02 |

| ValueRay RSI | 25.40 |

| Volatility GJR Garch 1y | 29.61% |

| Price / SMA 50 | -6.71% |

| Price / SMA 200 | 4.98% |

| Current Volume | 146.2k |

| Average Volume 20d | 297.1k |

External Links for BWY Stock

As of April 25, 2024, the stock is trading at GBX 2488.00 with a total of 146,214 shares traded.

Over the past week, the price has changed by +0.97%, over one month by -5.47%, over three months by -7.16% and over the past year by +14.32%.

According to ValueRays Forecast Model, BWY Bellway PLC will be worth about 2522.9 in April 2025. The stock is currently trading at 2488.00. This means that the stock has a potential upside of +1.4%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 2967.5 | 19.3 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 2522.9 | 1.40 |