Direct Line Insurance Group plc (DLG)

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00BY9D0Y18

Direct Line Insurance Group plc is a company in the United Kingdom that offers various general insurance products. They have four main divisions: Motor, Home, Rescue, and Other Personal Lines, as well as Commercial insurance for businesses. Their products include motor, home, travel, creditor, and pet insurance, catering to different customer needs, including mid-to-high-net worth clients.

In addition to insurance offerings, Direct Line Insurance Group plc provides a range of services such as claims management, capital management, motor vehicle repairs, legal services, and breakdown recovery. They also serve small and medium-sized enterprises with commercial insurance solutions.

The company distributes its insurance products through direct channels like price comparison websites and phones, as well as through partners and brokers, using various well-known brands like Direct Line, Churchill, Green Flag, and Privilege. They were previously known as RBS Insurance Group Limited until changing their name to Direct Line Insurance Group plc in 2012.

Direct Line Insurance Group plc has a long-standing history, being established in 1985 and is headquartered in Bromley, the United Kingdom. For more information, you can visit their website at https://www.directlinegroup.co.uk.

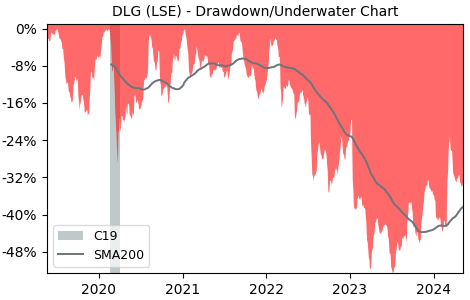

Drawdown (Underwater) Chart

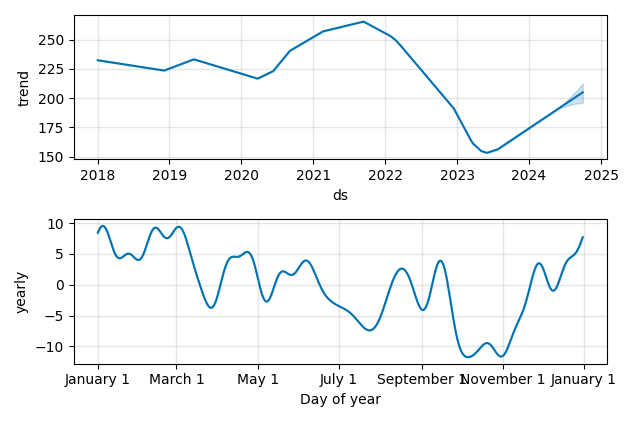

Overall Trend and Yearly Seasonality

DLG Stock Overview

| Market Cap in USD | 32m |

| Sector | Financial Services |

| Industry | Insurance - Diversified |

| GiC SubIndustry | Property & Casualty Insurance |

| TER | 0.00% |

| IPO / Inception |

DLG Stock Ratings

| Growth 5y | -1.42 |

| Fundamental | 0.28 |

| Dividend | 1.84 |

| Rel. Performance vs Sector | -0.01 |

| Analysts | - |

| Fair Price Momentum | 204.59 GBX |

| Fair Price DCF | 7.29 GBX |

DLG Dividends

| Yield 12m | 2.10% |

| Yield on Cost 5y | 1.62% |

| Dividends CAGR 5y | -100.00% |

| Payout Consistency | 64.6% |

DLG Growth Ratios

| Growth 12m | 15.50% |

| Growth Correlation 12m | 43% |

| Growth Correlation 3m | 33% |

| CAGR 5y | -5.05% |

| Sharpe Ratio 12m | 0.24 |

| Alpha vs SP500 12m | -2.06 |

| Beta vs SP500 5y weekly | 0.71 |

| ValueRay RSI | 49.78 |

| Volatility GJR Garch 1y | 32.32% |

| Price / SMA 50 | 1.74% |

| Price / SMA 200 | 12.12% |

| Current Volume | 5007.9k |

| Average Volume 20d | 7963.8k |

External Links for DLG Stock

As of April 18, 2024, the stock is trading at GBX 190.50 with a total of 5,007,901 shares traded.

Over the past week, the price has changed by +0.53%, over one month by -6.91%, over three months by +15.53% and over the past year by +20.58%.

According to ValueRays Forecast Model, DLG Direct Line Insurance Group plc will be worth about 226 in April 2025. The stock is currently trading at 190.50. This means that the stock has a potential upside of +18.65%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 234.6 | 23.2% |

| Analysts Target Price | - | - |

| ValueRay Target Price | 226 | 18.7% |