The Evolution and Current Market Status of General Electric Company

History of General Electric Company

General Electric Company, often abbreviated as GE, has played a pivotal role in the modern industrial era. Founded in 1892 through the merger of Edison General Electric Company and Thomson-Houston Electric Company, GE stands as one of the United States' oldest and most significant companies. Initially focusing on electric lighting, the company rapidly expanded its operations to include a vast array of products and services.

Core and Side Businesses

During its extensive history, GE has ventured into myriad sectors. The company’s core business can be broadly categorized into aviation, healthcare, power, and renewable energy. GE Aviation is a world leader in jet engines and digital solutions, whereas GE Healthcare provide significant advancements in medical imaging and diagnostics. On the energy front, GE Power is a prominent player in power generation technologies, and GE Renewable Energy aims to harness the power of natural resources like wind and hydroelectric power.

Beyond these core areas, GE has also operated in sectors such as transportation, lighting, and digital technology through GE Digital, which offers software and industrial applications. Although some side businesses have been divested over the years, these moves were strategic, simplifying the company's focus and strengthening its financial standing.

Current Market Status

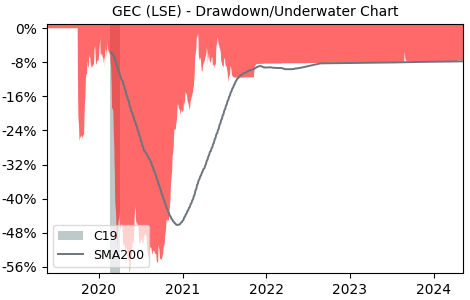

Today, General Electric Company continues to assert its dominance in the global market as a multi-industry giant. Despite facing challenges such as financial issues and competition, GE has embarked on significant restructuring to streamline operations and shed less profitable or non-core segments. This strategy has helped GE to stabilize and start rebuilding its market stature. Particularly, investments in renewable energy and health technology show promising growth avenues.

As of now, GE's adaptation to the fast-evolving technological landscape and commitment to solving some of the world’s complex challenges in energy, healthcare, and aviation indicate a resilient company that's prepared for future growth. While the stock market reflects the ups and downs common to large conglomerates, GE maintains a significant presence on the London Stock Exchange (LSE) under the ticker symbol GEC, showcasing its enduring legacy and continuous evolution.