HSBC Holdings PLC: Bridging Global Finance

History of HSBC

HSBC Holdings PLC, known globally as HSBC, started its journey in 1865. Its founding was motivated by the need to facilitate trade between Europe and Asia, especially in commodities such as silk and tea. The Hongkong and Shanghai Banking Corporation was the first brick in the formidable financial institution we see today. From its early days, HSBC established a foothold in various Asian markets before expanding globally.

Core Business

At its heart, HSBC is a multinational banking and financial services holding company. Its core business revolves around retail banking and wealth management, commercial banking, global banking and markets, and global private banking. By offering a wide range of financial products and services, HSBC caters to the needs of millions of customers worldwide, from individuals to large corporations and governments.

Side Businesses

Aside from its main banking services, HSBC has diversified its operations over the years. It has ventured into areas such as digital banking solutions, sustainability and green finance initiatives, and even insurance through its various subsidiaries. These side businesses not only complement its primary services but also reflect HSBC's commitment to innovation and environmental responsibility.

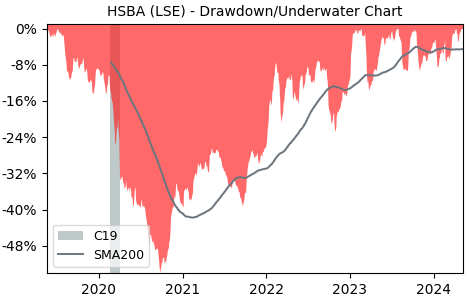

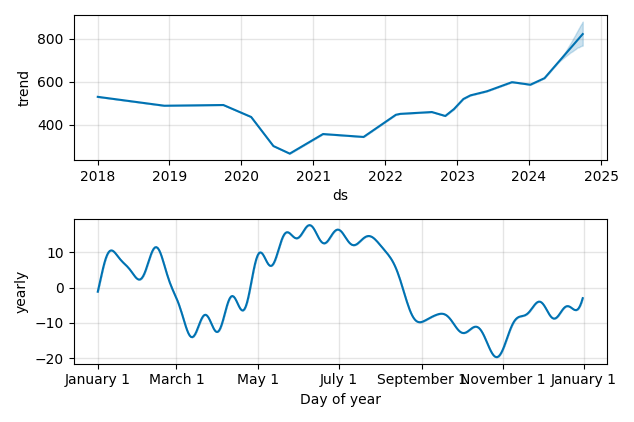

Current Market Status

Today, HSBC stands as one of the largest banking and financial services organizations in the world. With a presence in 64 countries and territories, its global reach is unmatched. Despite market fluctuations and regulatory challenges, HSBC continues to show resilience and adaptability. Its focus on strategic markets, especially in Asia, positions the bank well for future growth. The company's commitment to digital transformation and sustainable finance also indicates a forward-thinking approach in a rapidly evolving industry.