3I Group PLC (III) - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00B1YW4409

3I Group plc is a private equity firm with a focus on various investment areas. They specialize in mature companies, growth capital, middle markets, infrastructure, and management leveraged buyouts and buy-ins. Additionally, the firm offers infrastructure financing and debt management services to companies in the United Kingdom, Europe, Asia, and North America. Their debt management investments typically target senior and mezzanine corporate debt in large enterprises.

When it comes to private equity investments, 3I Group plc concentrates on sectors such as business and technology services, financial services, consumer goods, healthcare, renewable energy, wind, and industrial technology. For instance, within the business and technology services segment, they seek opportunities in sub-sectors like testing, inspection and certification, intelligent outsourcing, BPO, consultancy, human capital, governance, risk management, pharmaceutical services, education, facilities management, and industrial support services.

Furthermore, the firm's interest extends to the consumer sector, where they focus on multi-unit expansion, niche branded consumer goods, health and wellness, e-commerce, retail, food and beverage, and leisure. In the healthcare sector, 3I Group plc looks for investment prospects in outsourced medical device manufacturing, pharmaceutical services, bioprocessing, life science tools, diagnostics, pharmaceuticals, biotechnology, healthcare services, and more.

To learn more about their investments and services, you can visit their official website at https://www.3i.com.

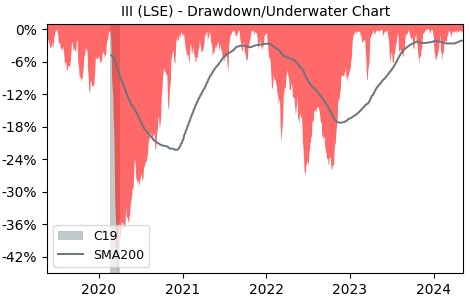

Drawdown (Underwater) Chart

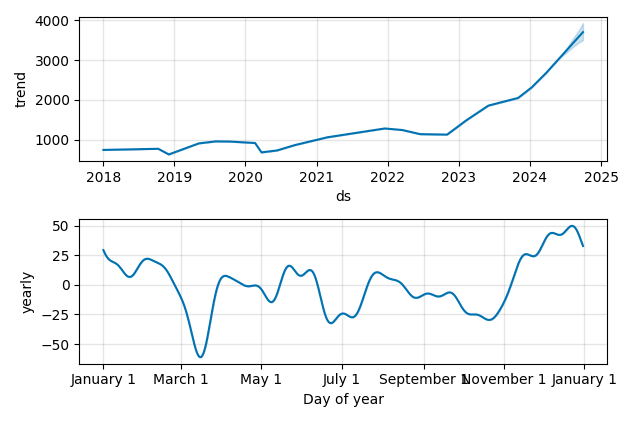

Overall Trend and Yearly Seasonality

III Stock Overview

| Market Cap in USD | 346m |

| Sector | Financial Services |

| Industry | Asset Management |

| GiC SubIndustry | Asset Management & Custody Banks |

| TER | 0.00% |

| IPO / Inception |

III Stock Ratings

| Growth 5y | 9.01 |

| Fundamental | 6.07 |

| Dividend | 8.07 |

| Rel. Performance vs Sector | 3.15 |

| Analysts | - |

| Fair Price Momentum | 3242.22 GBX |

| Fair Price DCF | 6.29 GBX |

III Dividends

| Yield 12m | 1.98% |

| Yield on Cost 5y | 6.13% |

| Dividends CAGR 5y | 8.45% |

| Payout Consistency | 93.7% |

III Growth Ratios

| Growth 12m | 70.78% |

| Growth Correlation 12m | 82% |

| Growth Correlation 3m | 80% |

| CAGR 5y | 25.31% |

| Sharpe Ratio 12m | 3.19 |

| Alpha vs SP500 12m | 46.36 |

| Beta vs SP500 5y weekly | 1.08 |

| ValueRay RSI | 70.00 |

| Volatility GJR Garch 1y | 22.25% |

| Price / SMA 50 | 9.48% |

| Price / SMA 200 | 28.23% |

| Current Volume | 1519.5k |

| Average Volume 20d | 2435.6k |

External Links for III Stock

As of April 20, 2024, the stock is trading at GBX 2846.00 with a total of 1,519,467 shares traded.

Over the past week, the price has changed by +0.96%, over one month by +12.62%, over three months by +22.36% and over the past year by +72.29%.

According to ValueRays Forecast Model, III 3I Group PLC will be worth about 3617.3 in April 2025. The stock is currently trading at 2846.00. This means that the stock has a potential upside of +27.1%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 2920.6 | 2.62% |

| Analysts Target Price | - | - |

| ValueRay Target Price | 3617.3 | 27.1% |