Understanding the SPDR® MSCI Japan UCITS ETF (JPJP)

History of SPDR® MSCI Japan UCITS ETF

The SPDR® MSCI Japan UCITS ETF, symbol JPJP, is a financial instrument designed to provide investors with a convenient way to gain exposure to the Japanese equity market. It tracks the performance of the MSCI Japan Index, representing large and mid-sized companies in Japan. The fund was established to offer a transparent, cost-effective means for investors outside Japan to access the Japanese stock market's growth potential.

Core Business and Side Business

Core Business

The core business of JPJP is to track the performance of the MSCI Japan Index as closely as possible. This involves investing in a portfolio of stocks that, to a large extent, replicates the stock composition of the index. By doing so, the ETF aims to mimic the Index's return, before fees and expenses. This strategy allows investors to benefit from the overall growth of Japan's economy and its stock market in a straightforward and cost-effective manner.

Side Business

While the SPDR® MSCI Japan UCITS ETF's primary focus is tracking the MSCI Japan Index, it may also engage in securities lending. Securities lending can provide additional income to the fund, which may help reduce the total cost of ownership for investors. However, this practice is conducted within a regulated framework to manage risks carefully.

Current Market Status

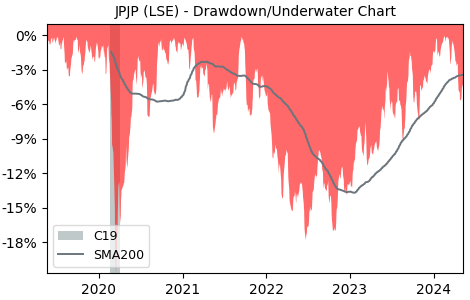

As of the most recent update, the SPDR® MSCI Japan UCITS ETF continues to be a popular choice among investors seeking exposure to the Japanese equity market. Its performance closely mirrors the economic and stock market trends in Japan, making it a useful tool for investors looking to diversify their portfolios with Japanese equities. The ETF's assets under management, its liquidity and its performance relative to the MSCI Japan Index are key indicators of its current market status and attractiveness to investors.