Mitie Group PLC (MTO) - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB0004657408

Mitie Group plc, with its numerous subsidiaries, specializes in providing strategic outsourcing services both domestically in the UK and on a global level. The company is structured into eight segments, including Business Services, Technical Services, Central Government & Defense, Communities, Care & Custody, Landscapes, Waste, and operations based in Spain.

Delving into specifics, Mitie offers a wide array of services such as security solutions involving manned guarding, technology-driven monitoring tools, fire and security system installations, and general, specialist, and technical cleaning services for various types of establishments. Additionally, they engage in technology-driven engineering services, maintenance, mechanical and electrical projects, energy and environmental management, air quality solutions, telecoms, energy services, and remote asset monitoring.

Moreover, the company extends its facilities management services to central government and defense contracts, focusing on decarbonization initiatives and engineering solutions. They deliver comprehensive integrated facilities management services to public sector entities, emphasizing community spaces in healthcare, education, emergency services, and local government. Other services include portering, public services in immigration and healthcare, landscaping services, waste management, and treatment solutions.

Founded in 1936, Mitie Group plc is headquartered in London, UK. For further information, visit their website at https://www.mitie.com.

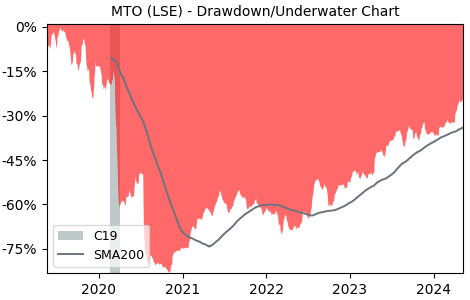

Drawdown (Underwater) Chart

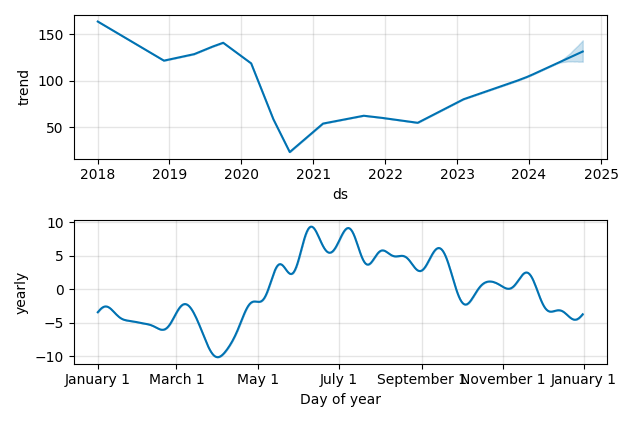

Overall Trend and Yearly Seasonality

MTO Stock Overview

| Market Cap in USD | 19m |

| Sector | Industrials |

| Industry | Specialty Business Services |

| GiC SubIndustry | Environmental & Facilities Services |

| TER | 0.00% |

| IPO / Inception |

MTO Stock Ratings

| Growth 5y | 1.55 |

| Fundamental | 53.6 |

| Dividend | 4.18 |

| Rel. Performance vs Sector | 1.90 |

| Analysts | - |

| Fair Price Momentum | 114.21 GBX |

| Fair Price DCF | 2.79 GBX |

MTO Dividends

| Yield 12m | 2.67% |

| Yield on Cost 5y | 2.70% |

| Dividends CAGR 5y | -4.36% |

| Payout Consistency | 89.8% |

MTO Growth Ratios

| Growth 12m | 34.19% |

| Growth Correlation 12m | 62% |

| Growth Correlation 3m | 61% |

| CAGR 5y | 0.24% |

| Sharpe Ratio 12m | 1.12 |

| Alpha vs SP500 12m | 17.14 |

| Beta vs SP500 5y weekly | 0.56 |

| ValueRay RSI | 95.38 |

| Volatility GJR Garch 1y | 43.25% |

| Price / SMA 50 | 11.5% |

| Price / SMA 200 | 18.18% |

| Current Volume | 4142.5k |

| Average Volume 20d | 3115.3k |

External Links for MTO Stock

As of April 25, 2024, the stock is trading at GBX 120.00 with a total of 4,142,532 shares traded.

Over the past week, the price has changed by +3.45%, over one month by +13.85%, over three months by +21.46% and over the past year by +34.62%.

According to ValueRays Forecast Model, MTO Mitie Group PLC will be worth about 125.2 in April 2025. The stock is currently trading at 120.00. This means that the stock has a potential upside of +4.32%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 133.4 | 11.2 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 125.2 | 4.32 |