Smith & Nephew PLC (SN) - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB0009223206

Smith & Nephew plc is a healthcare company based in the United Kingdom that specializes in developing, manufacturing, marketing, and selling medical devices and services worldwide. Founded in 1856 and headquartered in Watford, the company operates through three main segments: Orthopaedics, Sports Medicine & ENT, and Advanced Wound Management.

The company offers a wide range of products, including knee and hip implants for replacement and revision procedures, trauma and extremities products for fracture stabilization, sports medicine joint repair products for minimally invasive surgery, and arthroscopic enabling technologies for visualization and tissue resection inside joints. It also provides ear, nose, and throat solutions as well as advanced wound care products for acute and chronic wounds.

Smith & Nephew's portfolio includes advanced wound bioactives, regenerative medicine products, and wound devices such as negative pressure therapy systems. The company primarily serves healthcare providers and aims to deliver innovative solutions for the treatment and prevention of various medical conditions.

For more information about Smith & Nephew plc, you can visit their official website: https://www.smith-nephew.com

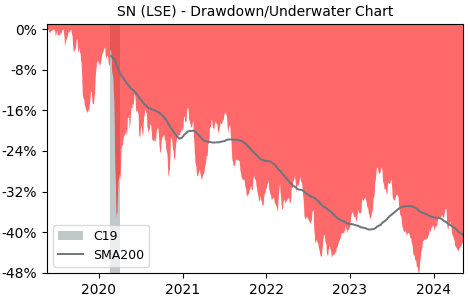

Drawdown (Underwater) Chart

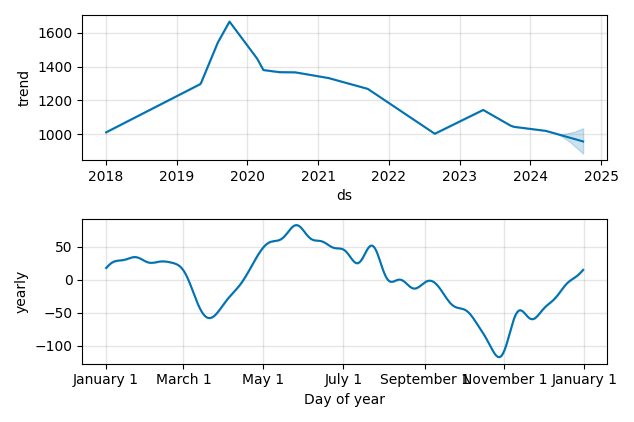

Overall Trend and Yearly Seasonality

SN Stock Overview

| Market Cap in USD | 107m |

| Sector | Healthcare |

| Industry | Medical Devices |

| GiC SubIndustry | Health Care Equipment |

| TER | 0.00% |

| IPO / Inception | 1999-11-16 |

SN Stock Ratings

| Growth 5y | -3.82 |

| Fundamental | 24.8 |

| Dividend | 6.19 |

| Rel. Performance vs Sector | -2.26 |

| Analysts | - |

| Fair Price Momentum | 834.77 GBX |

| Fair Price DCF | 0.70 GBX |

SN Dividends

| Yield 12m | 3.90% |

| Yield on Cost 5y | 2.96% |

| Dividends CAGR 5y | 0.60% |

| Payout Consistency | 96.4% |

SN Growth Ratios

| Growth 12m | -20.58% |

| Growth Correlation 12m | -39% |

| Growth Correlation 3m | -62% |

| CAGR 5y | -5.18% |

| Sharpe Ratio 12m | -1.28 |

| Alpha vs SP500 12m | -38.60 |

| Beta vs SP500 5y weekly | 0.73 |

| ValueRay RSI | 51.06 |

| Volatility GJR Garch 1y | 24.79% |

| Price / SMA 50 | -5.22% |

| Price / SMA 200 | -5.07% |

| Current Volume | 1839.8k |

| Average Volume 20d | 4063.7k |

External Links for SN Stock

As of April 23, 2024, the stock is trading at GBX 974.80 with a total of 1,839,752 shares traded.

Over the past week, the price has changed by +1.69%, over one month by -4.06%, over three months by -10.83% and over the past year by -20.79%.

According to ValueRays Forecast Model, SN Smith & Nephew PLC will be worth about 918.2 in April 2025. The stock is currently trading at 974.80. This means that the stock has a potential downside of -5.81%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 14 | -98.6 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 918.2 | -5.81 |