Senior PLC (SNR) - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB0007958233

Senior plc, listed on the London Stock Exchange under the ticker symbol SNR, is a prominent player in the global market. The company specializes in developing, manufacturing, and distributing cutting-edge components and systems catering to aerospace, defense, land vehicle, power, and energy sectors.

Operating across two key segments, Aerospace and Flexonics, Senior plc offers a wide array of innovative solutions. In the aerospace domain, the company provides fluid conveyance systems, gas turbine engines, and precision-machined airframe components and structures. These products range from ducting systems to engine components, catering to the diverse needs of original equipment manufacturers.

Moreover, Senior plc's Flexonics division focuses on emission control products for land vehicles, including exhaust gas recycling coolers and fuel distribution systems. The company also excels in industrial process control solutions, offering flexible hose assemblies, fuel cells, heat exchangers, and precision-machined components like expansion joints, dampers, and diverters.

Established in 1836 and headquartered in Rickmansworth, United Kingdom, Senior plc has a rich history of engineering excellence. Formerly known as Senior Engineering Group plc, the company rebranded to Senior plc in 1999 to reflect its diversified product portfolio and global reach. For more information on Senior plc, visit their official website at https://www.seniorplc.com.

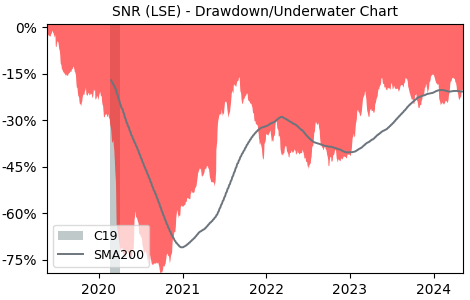

Drawdown (Underwater) Chart

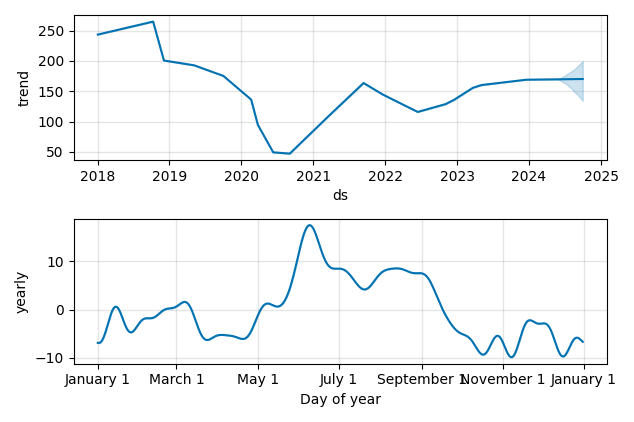

Overall Trend and Yearly Seasonality

SNR Stock Overview

| Market Cap in USD | 9m |

| Sector | Industrials |

| Industry | Aerospace & Defense |

| GiC SubIndustry | Aerospace & Defense |

| TER | 0.00% |

| IPO / Inception |

SNR Stock Ratings

| Growth 5y | -0.14 |

| Fundamental | 52.9 |

| Dividend | 2.32 |

| Rel. Performance vs Sector | -0.98 |

| Analysts | - |

| Fair Price Momentum | 143.58 GBX |

| Fair Price DCF | 1.38 GBX |

SNR Dividends

| Yield 12m | 1.00% |

| Yield on Cost 5y | 0.80% |

| Dividends CAGR 5y | -26.60% |

| Payout Consistency | 89.8% |

SNR Growth Ratios

| Growth 12m | -2.09% |

| Growth Correlation 12m | -10% |

| Growth Correlation 3m | 42% |

| CAGR 5y | -4.39% |

| Sharpe Ratio 12m | -0.34 |

| Alpha vs SP500 12m | -21.96 |

| Beta vs SP500 5y weekly | 0.68 |

| ValueRay RSI | 12.71 |

| Volatility GJR Garch 1y | 27.31% |

| Price / SMA 50 | -4.19% |

| Price / SMA 200 | -4.4% |

| Current Volume | 271k |

| Average Volume 20d | 533.7k |

External Links for SNR Stock

As of April 25, 2024, the stock is trading at GBX 160.00 with a total of 270,975 shares traded.

Over the past week, the price has changed by -3.15%, over one month by -9.30%, over three months by +0.25% and over the past year by -1.37%.

According to ValueRays Forecast Model, SNR Senior PLC will be worth about 158.9 in April 2025. The stock is currently trading at 160.00. This means that the stock has a potential downside of -0.66%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 211 | 31.9 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 158.9 | -0.66 |