Bank of America Corporation: A Comprehensive Overview

History of Bank of America

Bank of America, with its origins tracing back to the Bank of Italy in San Francisco in 1904, was founded by Amadeo Pietro Giannini. It was created to serve immigrants denied service by other banks. Eventually, it grew into the Bank of America and Italy and in 1930, it was renamed Bank of America. Over the decades, through various mergers and acquisitions, it has grown into one of the largest banking institutions in the world.

Core Business

The core business of Bank of America revolves around providing a wide range of banking and financial services. These include consumer banking, wealth management, and commercial banking for a diverse set of clients from individuals to large corporations. Additionally, it operates Merrill Lynch for investment banking and brokerage services, highlighting its strength in asset management and serving high-net-worth clients.

Side Business Ventures

Apart from its main banking operations, Bank of America has various side business ventures. These include, but are not limited to, insurance services, mortgage lending, and credit cards. The bank's strategy includes expanding these ancillary services to complement its core offerings, enhancing overall customer satisfaction and revenue streams.

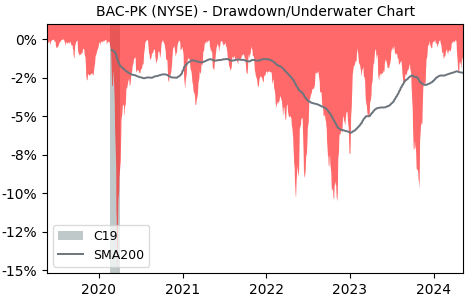

Current Market Status

As of the latest market analysis, Bank of America Corporation (NYSE:BAC-PK) remains a giant in the financial sector. Despite the challenges posed by economic fluctuations and competitive pressures, it continues to hold a significant market share in the banking industry. The corporation's strategic initiatives aimed at digital transformation and investment in sustainable financial services have positioned it well for future growth. Investors and clients alike watch closely as Bank of America navigates the evolving financial landscape.