CNH Industrial N.V. (CNHI) - Stock Price & Dividends

Exchange: USA Stocks • Country: United Kingdom • Currency: USD • Type: Common Stock • ISIN: NL0010545661

CNH Industrial N.V., a company that offers a range of equipment and services, is involved in the development, manufacturing, marketing, sale, and financing of agricultural and construction machinery across different regions such as North America, Europe, the Middle East, Africa, South America, and the Asia Pacific.

The company operates through three key segments: Agriculture, Construction, and Financial Services. The Agriculture division produces and distributes various farm machinery and tools, including tractors, combines, harvesters, planting equipment, and material handling tools under well-known brands like New Holland Agriculture and Case IH. These products cater to the needs of farmers and agricultural businesses.

In the Construction segment, CNH Industrial N.V. designs, manufactures, and sells construction equipment such as excavators, loaders, dozers, and backhoes under brands like CASE Construction Equipment and New Holland Construction. These machines are used in various construction projects globally.

The Financial Services arm of the company provides financing options to customers for the purchase of new and used agricultural and construction equipment. They also offer financial solutions to dealers and distributors, alongside trade receivables factoring services to support financial operations within the company. Additionally, they extend financial services to Iveco Group companies in several regions.

Established in 1842, CNH Industrial N.V. has its headquarters in London, the United Kingdom. For more information, you can visit their website at https://www.cnhindustrial.com.

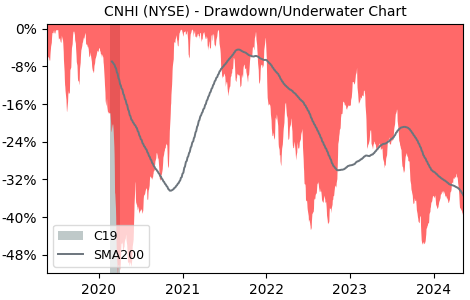

Drawdown (Underwater) Chart

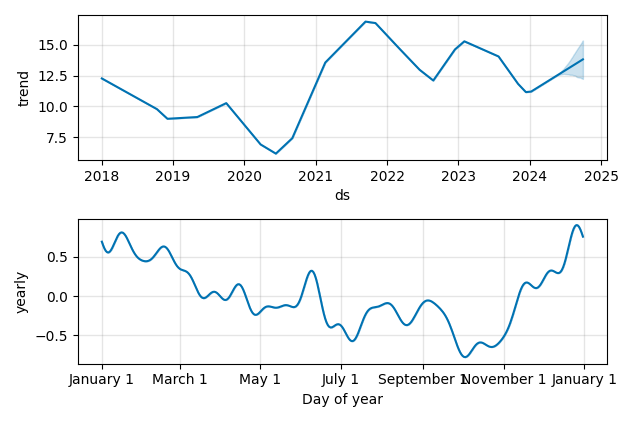

Overall Trend and Yearly Seasonality

CNHI Stock Overview

| Market Cap in USD | 16,140m |

| Sector | Industrials |

| Industry | Farm & Heavy Construction Machinery |

| GiC SubIndustry | Agricultural & Farm Machinery |

| TER | 0.00% |

| IPO / Inception | 2013-09-30 |

CNHI Stock Ratings

| Growth 5y | 1.21 |

| Fundamental | 0.77 |

| Dividend | 7.80 |

| Rel. Performance vs Sector | -3.38 |

| Analysts | 3.95/5 |

| Fair Price Momentum | 11.45 USD |

| Fair Price DCF | - |

CNHI Dividends

| Yield 12m | 3.09% |

| Yield on Cost 5y | 3.77% |

| Dividends CAGR 5y | 16.88% |

| Payout Consistency | 89.6% |

CNHI Growth Ratios

| Growth 12m | -12.74% |

| Growth Correlation 12m | -36% |

| Growth Correlation 3m | 48% |

| CAGR 5y | 4.10% |

| Sharpe Ratio 12m | -0.60 |

| Alpha vs SP500 12m | -40.76 |

| Beta vs SP500 5y weekly | 1.28 |

| ValueRay RSI | 34.20 |

| Volatility GJR Garch 1y | 31.36% |

| Price / SMA 50 | 0.24% |

| Price / SMA 200 | 0.08% |

| Current Volume | 6148.1k |

| Average Volume 20d | 8606.1k |

External Links for CNHI Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 19, 2024, the stock is trading at USD 12.40 with a total of 6,148,089 shares traded.

Over the past week, the price has changed by -4.32%, over one month by +0.32%, over three months by +7.17% and over the past year by -13.75%.

According to ValueRays Forecast Model, CNHI CNH Industrial N.V. will be worth about 12.4 in April 2025. The stock is currently trading at 12.40. This means that the stock has a potential downside of -0.32%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 15.6 | 25.5% |

| Analysts Target Price | 17.4 | 40.2% |

| ValueRay Target Price | 12.4 | -0.32% |