A Look into JPMorgan Chase & Co

History and Evolution

JPMorgan Chase & Co, one of the oldest financial institutions, has its roots stretching back to 1799. It was initially established in New York City, evolving through over 1,200 predecessor institutions. The iconic J.P. Morgan brand was amalgamated in 2000 when Chase Manhattan Corporation merged with J.P. Morgan & Co. This merger marked a significant milestone, combining Chase's extensive consumer banking operations with J.P. Morgan's prowess in investment banking to create a financial behemoth.

Core Businesses

Today, JPMorgan Chase & Co operates in four main areas: Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking, and Asset & Wealth Management. The Consumer & Community Banking segment provides a wide range of services, including personal banking, credit cards, mortgages, and auto financing. The Corporate & Investment Bank, known for its advisory services, underwriting, financing, market making, and research in global financial markets, plays a crucial role in the company's operations. Meanwhile, the Commercial Banking and Asset & Wealth Management segments offer tailored financial services and investment strategies for various clients, from small businesses to large corporations and high-net-worth individuals.

Side Businesses

Beyond its core operations, JPMorgan Chase & Co has ventured into technological advancements and sustainability projects. The firm heavily invests in blockchain technology, cybersecurity, and artificial intelligence to enhance its banking services. Additionally, it has taken significant strides towards sustainability, committing to various environmental initiatives and green investments.

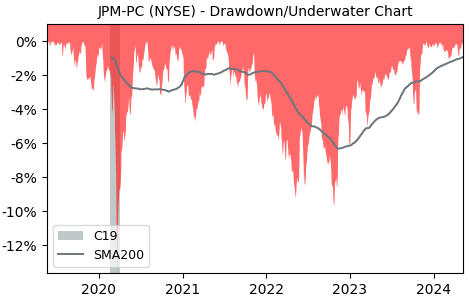

Current Market Status

As of 2023, JPMorgan Chase & Co remains a leading figure in the financial industry, holding its ground as one of the largest banks in the United States by assets. It has shown resilience and adaptability in the face of economic fluctuations, regulatory changes, and technological innovations. The firm's extensive history, robust business model, and strategic initiatives continue to attract investors and clients worldwide, securing its position in the constantly evolving market landscape.