Velo3D (VLD) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US92259N1046

Velo3D, Inc. is a leading manufacturer of metal additive three-dimensional printers based in the United States, serving clients globally. Their innovative printers are specifically designed for producing high-value components used in various industries, including space exploration, aviation, and industrial manufacturing. These printers are either sold to customers or offered on lease basis for their business operations.

The company offers a range of cutting-edge products and software solutions to enhance the additive manufacturing process. This includes their Flow software for precise scanning of part designs, Sapphire and Sapphire XC printers, Assure quality control software for process measurements, and Intelligent Fusion technology for optimal control of the printing process. Additionally, Velo3D provides comprehensive support services to ensure seamless operations for their clients.

Catering to a diverse customer base, Velo3D serves a wide range of businesses from small to large enterprises, including Fortune 500 companies in sectors such as aerospace, defense, energy, and industrial manufacturing. Since its establishment in 2014, the company's headquarters are located in Campbell, California. For more information, visit their official website at https://www.velo3d.com.

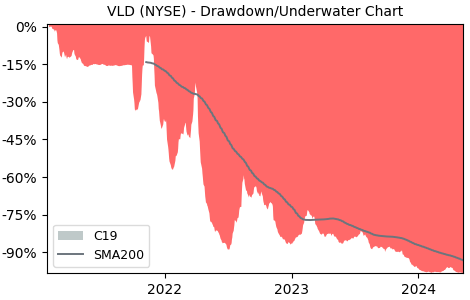

Drawdown (Underwater) Chart

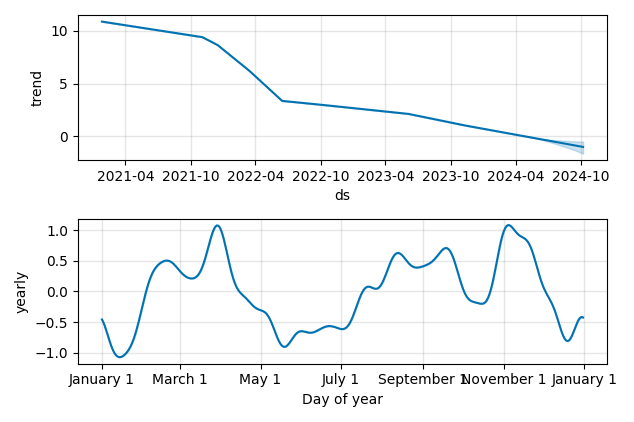

Overall Trend and Yearly Seasonality

VLD Stock Overview

| Market Cap in USD | 120m |

| Sector | Technology |

| Industry | Computer Hardware |

| GiC SubIndustry | Electronic Equipment & Instruments |

| TER | 0.00% |

| IPO / Inception | 2021-09-29 |

VLD Stock Ratings

| Growth 5y | -6.81 |

| Fundamental | -70.5 |

| Dividend | - |

| Rel. Performance vs Sector | -24.74 |

| Analysts | 4.50/5 |

| Fair Price Momentum | 0.12 USD |

| Fair Price DCF | - |

VLD Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

VLD Growth Ratios

| Growth 12m | -87.90% |

| Growth Correlation 12m | -73% |

| Growth Correlation 3m | 29% |

| CAGR 5y | -68.88% |

| Sharpe Ratio 12m | -0.72 |

| Alpha vs SP500 12m | -140.03 |

| Beta vs SP500 5y weekly | 2.22 |

| ValueRay RSI | 40.22 |

| Volatility GJR Garch 1y | 198.55% |

| Price / SMA 50 | -33.33% |

| Price / SMA 200 | -75.76% |

| Current Volume | 2897.5k |

| Average Volume 20d | 8515k |

External Links for VLD Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 24, 2024, the stock is trading at USD 0.24 with a total of 2,897,519 shares traded.

Over the past week, the price has changed by -15.13%, over one month by -54.72%, over three months by -3.74% and over the past year by -88.89%.

According to ValueRays Forecast Model, VLD Velo3D will be worth about 0.1 in April 2025. The stock is currently trading at 0.24. This means that the stock has a potential downside of -41.67%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 1.5 | 517 |

| Analysts Target Price | 3.1 | 1,192 |

| ValueRay Target Price | 0.1 | -41.7 |