Zuora (ZUO) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US98983V1061

Zuora, Inc., trades on the New York Stock Exchange under the ticker symbol ZUO. This innovative company and its subsidiaries specialize in providing a cloud-based platform devoted to revolutionizing the way businesses across various sectors can transition to a subscription-based model. By leveraging the Zuora platform, businesses gain access to a powerful orchestration engine, allowing for seamless management of quoting, cash flow, and revenue operations.

In addition to their platform, Zuora also offers a suite of complementary products designed to optimize subscription businesses. These include Zuora Billing, which simplifies payment terms and invoicing; Zuora Revenue, a solution for streamlining revenue recognition; and Zuora CPQ, which helps configure and price subscription options. Furthermore, Zuora provides Zephr, a digital subscriber platform tailored for the media and publishing industry, along with Zuora Collect, a tool dedicated to managing payments for subscription-based operations.

Zuora's products are made available to clients through a network of systems integrators, consultants, and ecosystem partners. The company was founded in 2006 with its headquarters located in Redwood City, California. For more information, you can visit their website at https://www.zuora.com.

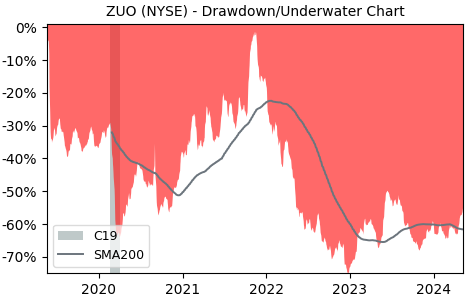

Drawdown (Underwater) Chart

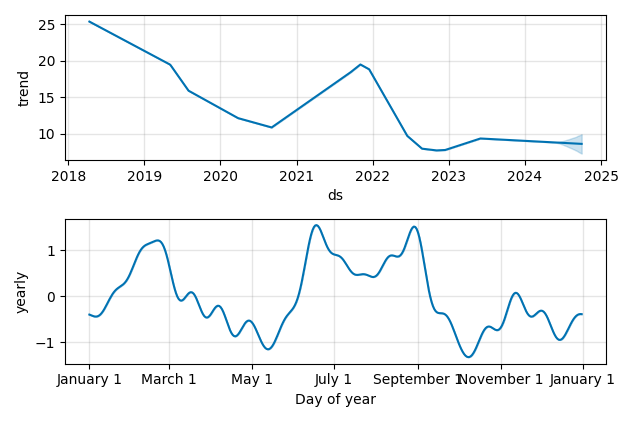

Overall Trend and Yearly Seasonality

ZUO Stock Overview

| Market Cap in USD | 1,241m |

| Sector | Technology |

| Industry | Software - Infrastructure |

| GiC SubIndustry | Systems Software |

| TER | 0.00% |

| IPO / Inception | 2018-04-12 |

ZUO Stock Ratings

| Growth 5y | -3.49 |

| Fundamental | -40.9 |

| Dividend | - |

| Rel. Performance vs Sector | -1.37 |

| Analysts | 4.14/5 |

| Fair Price Momentum | 10.29 USD |

| Fair Price DCF | - |

ZUO Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

ZUO Growth Ratios

| Growth 12m | 25.53% |

| Growth Correlation 12m | -15% |

| Growth Correlation 3m | 7% |

| CAGR 5y | -14.60% |

| Sharpe Ratio 12m | 0.43 |

| Alpha vs SP500 12m | -14.19 |

| Beta vs SP500 5y weekly | 1.60 |

| ValueRay RSI | 92.85 |

| Volatility GJR Garch 1y | 87.72% |

| Price / SMA 50 | 14.63% |

| Price / SMA 200 | 12.7% |

| Current Volume | 1710.2k |

| Average Volume 20d | 2284.4k |

External Links for ZUO Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 26, 2024, the stock is trading at USD 10.03 with a total of 1,710,200 shares traded.

Over the past week, the price has changed by +6.03%, over one month by +13.33%, over three months by +8.90% and over the past year by +19.40%.

According to ValueRays Forecast Model, ZUO Zuora will be worth about 11.5 in April 2025. The stock is currently trading at 10.03. This means that the stock has a potential upside of +14.56%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 11.6 | 15.4 |

| Analysts Target Price | 13 | 29.6 |

| ValueRay Target Price | 11.5 | 14.6 |