The Story of AXA SA: From Origins to Market Presence

History and Evolution

AXA SA, a titan in the global insurance realm, embarked on its journey in 1816, originally named Ancienne Mutuelle. The company underwent significant transformation, evolving with time, and rebranding as AXA in 1985. The strategic shift was not merely nominal but marked the beginning of its global expansion. The acquisition of several firms, including the Drouot Group, Equitable Holdings, and Guardian Royal Exchange, underscored its ambition and leveraged its footprint on the international stage.

Core and Side Businesses

At its core, AXA revolves around insurance and risk management, offering a vast array of products and services. These include life insurance, health insurance, property and casualty insurance, and various financial services. This broad portfolio caters to a diverse clientele, ranging from individuals to multinational corporations.

Besides its primary insurance operations, AXA is also an adept player in investment management. Through subsidiaries like AXA Investment Managers, it offers an assortment of investment solutions, thereby solidifying its stance as a multifaceted financial services firm. The company also explores innovative domains such as digital health services, aiming to elevate the healthcare experience through advanced technology.

Current Market Status

With the insurance industry's landscape continually evolving, AXA maintains a robust position. It ranks as one of the world’s leading insurance groups, testament to its strategic initiatives and global presence. AXA's commitment to sustainability and digital transformation has sparked interest among environmentally and technologically conscious investors.

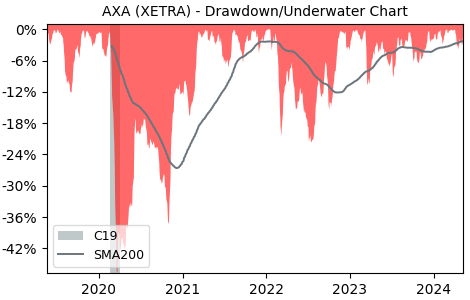

However, like many in its sector, AXA faces challenges including market volatility and regulatory changes. Despite these hurdles, its broad diversification and emphasis on resilient sectors suggest a steady path ahead. The company's adaptability and forward-thinking approach are likely to continue playing a pivotal role in its market status.