The Boeing Company: A Comprehensive Overview

History of The Boeing Company

The Boeing Company, with its ticker symbol XETRA:BCO on the stock exchange, has a rich history dating back to its founding in 1916 by William Boeing. Initially, the company focused on building military seaplanes. Over the years, Boeing evolved into a leading manufacturer of commercial jetliners and space, defense, and security systems.

Core Business

Boeing’s core business is centered around the design and manufacture of commercial aircraft, which includes the famous 737, 747, 767, 777, and 787 series. These airplanes have become staples in global air travel, making Boeing a critical player in the aviation industry.

Side Businesses

Beyond commercial aircraft, Boeing has diversified its operations into several side businesses. These include:

- Defense, Space & Security: Providing military aircraft, satellites, and advanced information and communication systems.

- Global Services: Offering a wide range of services including repair and maintenance, upgrades, and logistics services for military and commercial customers.

Current Market Status

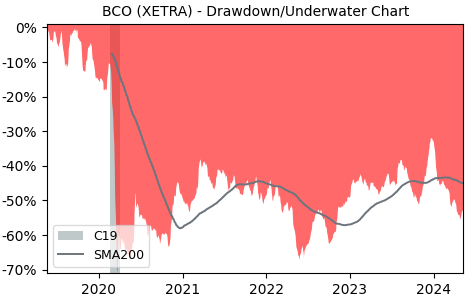

Today, The Boeing Company remains a prominent figure in the aerospace industry. Despite facing challenges like the 737 MAX crisis and the impact of the COVID-19 pandemic on air travel, Boeing is working towards recovery and reaffirming its position in the market. Initiatives to enhance safety measures, streamline operations, and focus on sustainability are key aspects of Boeing's strategy to navigate through current challenges and future uncertainties in the aerospace sector.