Orange SA (FTE) - Stock Price & Dividends

Exchange: XETRA Stock Exchange • Country: France • Currency: EUR • Type: Common Stock • ISIN: FR0000133308

Orange S.A., listed as XETRA:FTE, is a telecommunications company that provides a wide range of services to customers, businesses, and other operators across France and globally.

The company operates in various segments including France, Spain and Other European Countries, Africa and Middle East, Enterprise, Orange Business, Totem, International Carriers & Shared Services, and Mobile Financial Services.

Orange S.A. offers mobile services like voice, SMS, and data, as well as fixed broadband and narrowband services. It also provides B2B fixed solutions, network services, mobile handsets, broadband equipment, connected devices, and accessories.

In addition to telecommunications services, Orange S.A. offers IT and integration services such as unified communication and collaboration services, hosting, infrastructure services, customer relations management, security services, and video conferencing. The company also sells related equipment.

Orange S.A. further extends its services to national and international roaming, online advertising, mobile virtual network operators, network sharing, and mobile financial services. It markets its products and services under the Orange brand.

Formerly known as France Telecom, Orange S.A. rebranded in July 2013 and is headquartered in Issy-les-Moulineaux, France. For more information, you can visit their website at https://www.orange.com.

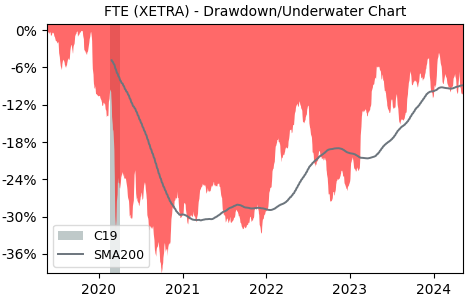

Drawdown (Underwater) Chart

FTE Stock Overview

| Market Cap in USD | 29,588m |

| Sector | Communication Services |

| Industry | Telecom Services |

| GiC SubIndustry | Integrated Telecommunication Services |

| TER | 0.00% |

| IPO / Inception |

FTE Stock Ratings

| Growth 5y | 0.93 |

| Fundamental | 52.0 |

| Dividend | 6.16 |

| Rel. Performance vs Sector | -3.09 |

| Analysts | - |

| Fair Price Momentum | 9.80 EUR |

| Fair Price DCF | 61.56 EUR |

FTE Dividends

| Yield 12m | 6.61% |

| Yield on Cost 5y | 6.50% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 83.7% |

FTE Growth Ratios

| Growth 12m | -3.39% |

| Growth Correlation 12m | 18% |

| Growth Correlation 3m | -29% |

| CAGR 5y | -0.35% |

| Sharpe Ratio 12m | -0.61 |

| Alpha vs SP500 12m | -13.13 |

| Beta vs SP500 5y weekly | 0.21 |

| ValueRay RSI | 57.03 |

| Volatility GJR Garch 1y | 14.79% |

| Price / SMA 50 | -0.56% |

| Price / SMA 200 | -0.09% |

| Current Volume | 29k |

| Average Volume 20d | 6.1k |

External Links for FTE Stock

As of April 25, 2024, the stock is trading at EUR 10.59 with a total of 28,978 shares traded.

Over the past week, the price has changed by +0.24%, over one month by -0.48%, over three months by -5.88% and over the past year by -1.09%.

According to ValueRays Forecast Model, FTE Orange SA will be worth about 10.6 in April 2025. The stock is currently trading at 10.59. This means that the stock has a potential downside of -0.09%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 10.6 | -0.09 |