The Journey and Business of Citigroup Inc

History of Citigroup Inc

Citigroup Inc, often just called Citi, has a rich history that dates back to the founding of the City Bank of New York in 1812. Over centuries, it evolved through numerous mergers and expansions, becoming one of the largest banking conglomerates globally. A significant milestone in its history was the 1998 merger with Travelers Group, which highlighted the era of mega-mergers in the banking sector, although it later had to sell off some parts due to regulatory issues.

Core Business Activities

Citigroup's core business revolves around global consumer banking and institutional banking. This includes offering day-to-day banking services, credit products, investment services, and wealth management solutions for individuals and businesses around the world. The institution prides itself on its global presence, operating in numerous countries and serving millions of customers.

Side Businesses and Ventures

Beyond its main banking and financial services, Citi also engages in several side ventures. These include securities and brokerage services, transaction services, and various investments in financial technology startups through its Citi Ventures arm. This diversification helps Citi stay ahead in the competitive financial market by tapping into innovative financial services and technology.

Current Market Status

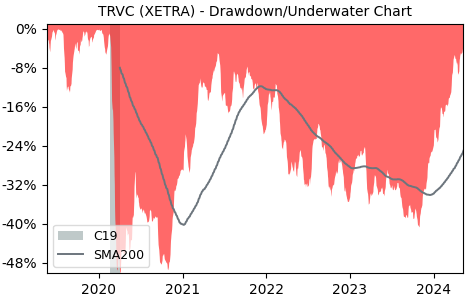

As of the latest updates, Citigroup Inc continues to be a leading player in the global financial market. Despite facing challenges like regulatory changes, economic fluctuations, and the impact of global events, Citi has managed to maintain its position thanks to its diverse service offerings and extensive global network. The company's stock, listed as TRVC on the XETRA trading platform, reflects its ongoing adaptation and resilience in the face of challenges.