Chemtrade Logistics Income Fund (CHE-UN)

Exchange: Toronto Exchange • Country: Canada • Currency: CAD • Type: Common Stock • ISIN: CA16387P1036

Sulphuric Acid, Sodium Chlorate, Sodium Nitrite, Sulphur, Zinc Oxide

Chemtrade Logistics Income Fund offers industrial chemicals and services in Canada, the United States, and South America. It operates in two segments, Sulphur and Water Chemicals (SWC), and Electrochemicals (EC). The company provides sulphuric acid, spent acid processing services, and inorganic coagulants for water treatment, sodium chlorate, sodium nitrite, and sodium hydrosulphite; and sulphur, chloralkali products, and zinc oxide. It also offers industrial services, such as processing by-products and waste streams. Chemtrade Logistics Income Fund was founded in 2001 and is headquartered in Toronto, Canada. Web URL: https://www.chemtradelogistics.com

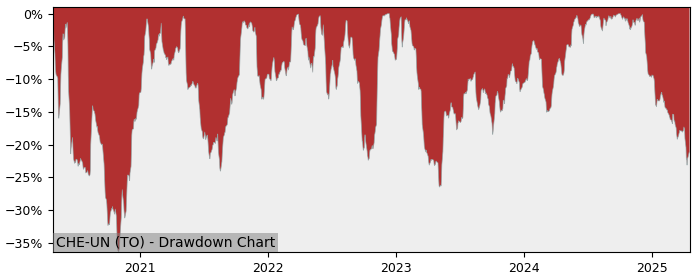

Drawdown (Underwater) Chart

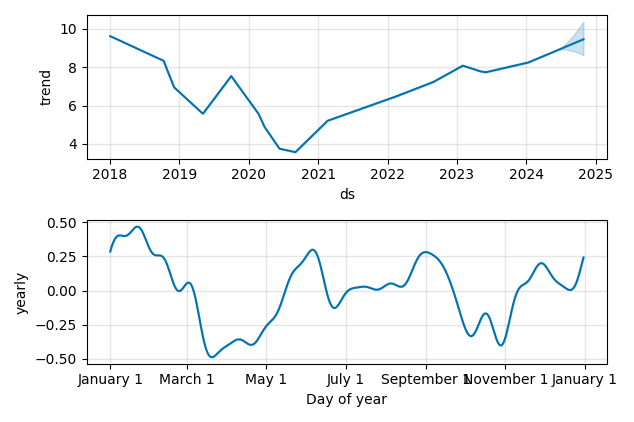

Overall Trend and Yearly Seasonality

CHE-UN Stock Overview

| Market Cap in USD | 710m |

| Sector | Basic Materials |

| Industry | Chemicals |

| GiC SubIndustry | Commodity Chemicals |

| TER | 0.00% |

| IPO / Inception |

CHE-UN Stock Ratings

| Growth 5y | 3.99 |

| Fundamental | 48.2 |

| Dividend | 4.69 |

| Rel. Performance vs Sector | 0.94 |

| Analysts | - |

| Fair Price Momentum | 8.44 CAD |

| Fair Price DCF | 56.11 CAD |

CHE-UN Dividends

| Yield 12m | 7.01% |

| Yield on Cost 5y | 10.20% |

| Dividends CAGR 5y | -12.94% |

| Payout Consistency | 93.9% |

CHE-UN Growth Ratios

| Growth 12m | 12.53% |

| Growth Correlation 12m | 42% |

| Growth Correlation 3m | 50% |

| CAGR 5y | 7.82% |

| CAGR/Mean DD 5y | 0.38 |

| Sharpe Ratio 12m | 0.31 |

| Alpha vs SP500 12m | -26.17 |

| Beta vs SP500 5y weekly | 1.38 |

| ValueRay RSI | 67.63 |

| Volatility GJR Garch 1y | 23.36% |

| Price / SMA 50 | 5.36% |

| Price / SMA 200 | 6.88% |

| Current Volume | 206.3k |

| Average Volume 20d | 182.6k |

External Links for CHE-UN Stock

What is the price of CHE-UN stocks?

As of May 16, 2024, the stock is trading at CAD 8.85 with a total of 206,271 shares traded.

Over the past week, the price has changed by +0.91%, over one month by +5.02%, over three months by +4.33% and over the past year by +15.39%.

As of May 16, 2024, the stock is trading at CAD 8.85 with a total of 206,271 shares traded.

Over the past week, the price has changed by +0.91%, over one month by +5.02%, over three months by +4.33% and over the past year by +15.39%.

What is the forecast for CHE-UN stock price target?

According to ValueRays Forecast Model, CHE-UN Chemtrade Logistics Income Fund will be worth about 9.2 in May 2025. The stock is currently trading at 8.85. This means that the stock has a potential upside of +4.18%.

According to ValueRays Forecast Model, CHE-UN Chemtrade Logistics Income Fund will be worth about 9.2 in May 2025. The stock is currently trading at 8.85. This means that the stock has a potential upside of +4.18%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 11.9 | 34.8 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 9.2 | 4.18 |