(IVOO) Vanguard S&P Mid-Cap - Performance 6.2% in 12m

IVOO performance: live returns, drawdowns, peer ranking & SPY comparison from 1w to 5y, all in one clean chart-driven dashboard.

Performance Rating

55.09%

#30 in Peer-Group

Rel. Strength

49.68%

#3753 in Stock-Universe

Total Return 12m

6.22%

#50 in Peer-Group

Total Return 5y

86.66%

#26 in Peer-Group

| P/E | Value |

|---|---|

| P/E Trailing | - |

| P/E Forward | - |

| High / Low | USD |

|---|---|

| 52 Week High | 114.05 USD |

| 52 Week Low | 86.58 USD |

| Sentiment | Value |

|---|---|

| VRO Trend Strength +-100 | 57.97 |

| Buy/Sell Signal +-5 | -1.60 |

| Support / Resistance | Levels |

|---|---|

| Support | |

| Resistance |

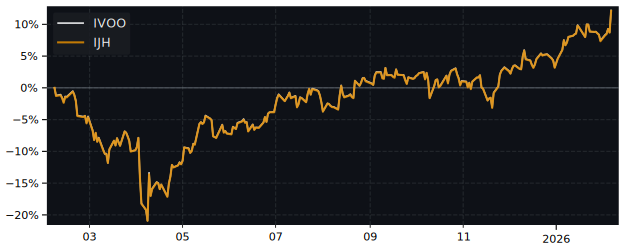

12m Total Return: IVOO (6.2%) vs SPY (12.8%)

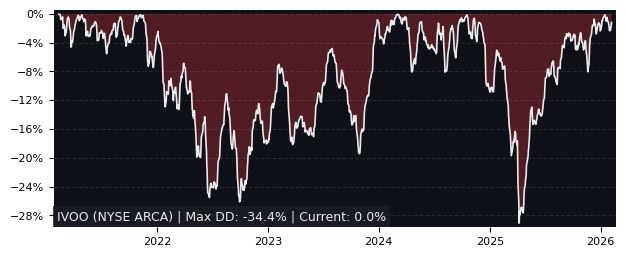

5y Drawdown (Underwater) Chart

Top Performer in Mid-Cap Blend

Overall best picks of Peer Group - Selected by proven GARP Predictive Metrics, sorted by Growth Rating

| Symbol | 1m | 12m | 5y | P/E | P/E Forward | PEG | EPS Stability | EPS CAGR |

|---|---|---|---|---|---|---|---|---|

| VFMV BATS Vanguard U.S. Minimum |

0.47% | 13% | 78.9% | - | - | - | - | - |

| USMF BATS WisdomTree U.S. Multifactor |

-0.81% | 11.7% | 83.8% | - | - | - | - | - |

| SPHB NYSE ARCA Invesco SP500 High Beta |

6.89% | 14.2% | 153% | - | - | - | - | - |

| TPLC NYSE ARCA Timothy Plan US Large/Mid |

0.75% | 9.6% | 89.6% | - | - | - | - | - |

| XMMO NYSE ARCA Invesco S&P MidCap Momentum |

0.84% | 11.5% | 124% | - | - | - | - | - |

| EUSA NYSE ARCA iShares MSCI USA Equal |

1.45% | 12.2% | 87.2% | - | - | - | - | - |

| VFMO BATS Vanguard U.S. Momentum |

2.07% | 13.2% | 110% | - | - | - | - | - |

| IMCB NYSE ARCA iShares Morningstar Mid-Cap |

1.37% | 12.8% | 85.4% | - | - | - | - | - |

Performance Comparison: IVOO vs SPY vs S&P 500

SPY (SPDR SP500 Trust ETF) is the Sector Benchmark for IVOO

| Total Return (including Dividends) | IVOO | SPY | S&P 500 |

|---|---|---|---|

| 1 Month | 0.48% | 3.01% | 3.01% |

| 3 Months | 1.83% | 5.82% | 5.82% |

| 12 Months | 6.22% | 12.82% | 12.82% |

| 5 Years | 86.66% | 114.16% | 114.16% |

| Trend Score (consistency of price movement) | IVOO | SPY | S&P 500 |

|---|---|---|---|

| 1 Month | 51.2% | 78.3% | 78.3% |

| 3 Months | 76.7% | 87.1% | 87.1% |

| 12 Months | -3.2% | 43.5% | 43.5% |

| 5 Years | 74.2% | 84% | 84% |

| Relative Strength (compared with Indexes) | Rank in Peer Group | vs. SPY | vs. S&P 500 |

|---|---|---|---|

| 1 Month | #48 | -2.46% | -2.46% |

| 3 Month | #42 | -3.77% | -3.77% |

| 12 Month | #52 | -5.85% | -5.85% |

| 5 Years | #33 | -12.84% | -12.84% |

FAQs

Does Vanguard S&P Mid-Cap (IVOO) outperform the market?

No,

over the last 12 months IVOO made 6.22%, while its related Sector, the SPDR SP500 Trust (SPY) made 12.82%.

Over the last 3 months IVOO made 1.83%, while SPY made 5.82%.

Performance Comparison IVOO vs Indeces and Sectors

Above 0 means better perfomance compared to Symbol in this Timeframe

IVOO vs. Indices

| Symbol | 1w | 1m | 6m | 12m | |

|---|---|---|---|---|---|

| US S&P 500 | SPY | -1% | -2.5% | -4.5% | -7% |

| US NASDAQ 100 | QQQ | -1.5% | -3.5% | -5.4% | -7% |

| German DAX 40 | DAX | 0.2% | 3.5% | -20.1% | -23% |

| Shanghai Shenzhen CSI 300 | CSI 300 | -2.6% | -3.8% | -5.1% | -13% |

| Hongkong Hang Seng | HSI | -3.4% | -7.7% | -23.5% | -29% |

| India NIFTY 50 | INDA | -1.3% | -0.4% | -6.2% | 6% |

| Brasil Bovespa | EWZ | 2.8% | 0.1% | -26.5% | -0% |

IVOO vs. Sectors

| Symbol | 1w | 1m | 6m | 12m | |

|---|---|---|---|---|---|

| Communication Services | XLC | -1% | -3.1% | -9.7% | -18% |

| Consumer Discretionary | XLY | -0.5% | 2% | 5.4% | -13% |

| Consumer Staples | XLP | 0.5% | 2.4% | -4.8% | -0% |

| Energy | XLE | 4.2% | -2.6% | -4.5% | 11% |

| Financial | XLF | -1.8% | -0.8% | -8.3% | -20% |

| Health Care | XLV | -0% | -1.3% | 0.3% | 13% |

| Industrial | XLI | -0.5% | -0.2% | -10.7% | -13% |

| Materials | XLB | 0.7% | 0.4% | -5.6% | 6% |

| Real Estate | XLRE | 1.5% | -0.2% | -5.4% | -6% |

| Technology | XLK | -2.4% | -7.1% | -6.9% | -5% |

| Utilities | XLU | 0.3% | 1.2% | -9.9% | -14% |

| Aerospace & Defense | XAR | -1.7% | -4.3% | -21.3% | -38% |

| Biotech | XBI | 0.2% | -4.5% | 7.2% | 17% |

| Homebuilder | XHB | -3.1% | 0.2% | 5.5% | 10% |

| Retail | XRT | 0.5% | 0.2% | 3.1% | 3% |

IVOO vs. Commodities

| Symbol | 1w | 1m | 6m | 12m | |

|---|---|---|---|---|---|

| Oil | USO | 11.8% | -8.48% | -3.16% | 13% |

| Natural Gas | UNG | 13.3% | 7.6% | -6% | 23% |

| Gold | GLD | 2% | -0.4% | -29.3% | -37% |

| Silver | SLV | 1.7% | -8.7% | -24.5% | -19% |

| Copper | CPER | -0.7% | -3.6% | -22.1% | -7% |

IVOO vs. Bonds

| Symbol | 1w | 1m | 6m | 12m | |

|---|---|---|---|---|---|

| iShares 20+ Years Bond | TLT | -0.1% | -2% | -4.3% | 10% |

| iShares High Yield Corp. Bond | HYG | 0.2% | -0.9% | -7.1% | -4% |