Nokia (NOA3) - Stock Price & Dividends

Exchange: XETRA Stock Exchange • Country: Finland • Currency: EUR • Type: Common Stock • ISIN: FI0009000681

Nokia Corporation, trading as XETRA:NOA3, offers a vast array of mobile, fixed, and cloud network solutions on a global scale. The company divides its operations into four key segments: Network Infrastructure, Mobile Networks, Cloud and Network Services, and Nokia Technologies.

Its product lineup includes radio access networks, microwave radio links, network management solutions, and various services like network optimization, deployment, and technical support. For fixed networking, Nokia provides fiber and copper-based infrastructure, Wi-Fi solutions for homes, and cloud services.

Moreover, Nokia delivers IP networking solutions for residential, business, mobile, cloud, and digital industry applications, along with optical network products like coherent optical transponders and wavelength-division multiplexers for various network applications.

Additionally, the company designs core network services, enterprise solutions, business applications, and cloud and cognitive services, catering to diverse needs such as security, automation, and private wireless connectivity.

Founded in 1865 and headquartered in Espoo, Finland, Nokia also offers hardware, software, service provisions, and licenses intellectual property, including patents and technologies. It serves a wide range of clients from communication service providers and web-scale companies to governments and digital developers. For more information, please visit their website: https://www.nokia.com.

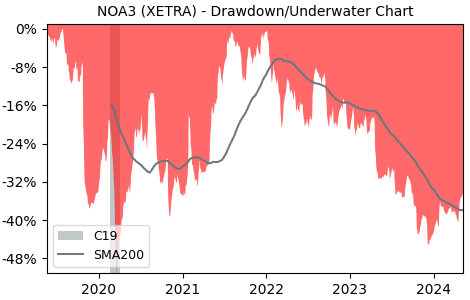

Drawdown (Underwater) Chart

NOA3 Stock Overview

| Market Cap in USD | 19,603m |

| Sector | Technology |

| Industry | Communication Equipment |

| GiC SubIndustry | Communications Equipment |

| TER | 0.00% |

| IPO / Inception |

NOA3 Stock Ratings

| Growth 5y | -1.46 |

| Fundamental | 43.2 |

| Dividend | 2.13 |

| Rel. Performance vs Sector | -5.33 |

| Analysts | - |

| Fair Price Momentum | 3.07 EUR |

| Fair Price DCF | 3.36 EUR |

NOA3 Dividends

| Yield 12m | 3.80% |

| Yield on Cost 5y | 3.07% |

| Dividends CAGR 5y | -11.27% |

| Payout Consistency | 73.3% |

NOA3 Growth Ratios

| Growth 12m | -5.37% |

| Growth Correlation 12m | -47% |

| Growth Correlation 3m | -30% |

| CAGR 5y | -4.14% |

| Sharpe Ratio 12m | -0.38 |

| Alpha vs SP500 12m | -31.38 |

| Beta vs SP500 5y weekly | 0.99 |

| ValueRay RSI | 97.49 |

| Volatility GJR Garch 1y | 30.81% |

| Price / SMA 50 | 5.56% |

| Price / SMA 200 | 4.59% |

| Current Volume | 375k |

| Average Volume 20d | 198.3k |

External Links for NOA3 Stock

As of April 25, 2024, the stock is trading at EUR 3.42 with a total of 374,980 shares traded.

Over the past week, the price has changed by +9.48%, over one month by +4.93%, over three months by +10.65% and over the past year by -8.35%.

According to ValueRays Forecast Model, NOA3 Nokia will be worth about 3.4 in April 2025. The stock is currently trading at 3.42. This means that the stock has a potential downside of -0.88%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 3.4 | -0.88 |