SBID - State Bank of India - Stock Price & Dividends

Exchange: London IL • Country: India • Currency: USD • Type: Common Stock • ISIN: -s

Banking, Loans, Accounts, Investments, Insurance

State Bank of India provides banking products and services to individuals, commercial enterprises, corporates, public bodies, and institutional customers in India and internationally. The company operates through Treasury, Corporate/Wholesale Banking, Retail Banking, Insurance Business, and Other Banking Business segments. It offers personal banking products and services, including current accounts, savings accounts, salary accounts, fixed and recurring deposits, and flexi and annual deposits; home, personal, auto, education, and gold loans, as well as loans against property and securities; overdrafts; mutual funds, insurance, equity trading, portfolio investment schemes, remittance services; and mobile, internet, and digital banking services. The company also provides corporate banking products and services comprising corporate accounts, working capital and project finance, deferred payment guarantees, corporate term loans, structured finance, dealer and channel financing, equipment leasing, loan syndication, construction equipment loans, financing Indian firms' overseas subsidiaries or JVs, cash management, and asset-backed loans, as well as trade and service products. In addition, it offers NRI services, including accounts and deposits, remittances, investments, and loans; agricultural banking and micro-credit to agriculturists and farmers; supply chain finance, and deposits and transaction banking services for SME customers; and international banking services. Further, the company provides treasury, broking, bill payment, and MICR services; and merchant banking, advisory, securities broking, business & management consultancy, trustee business, factoring, payment, asset management, investment management, credit cards, and custody and fund accounting services. It also offers support and business correspondent services. The company was founded in 1806 and is headquartered in Mumbai, India. Web URL: https://www.sbi.co.in

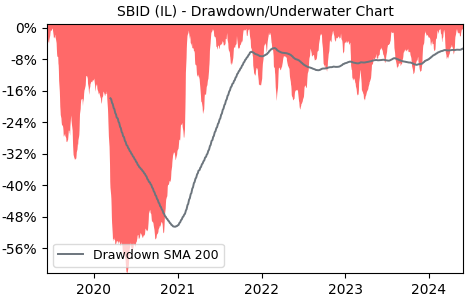

Drawdown (Underwater) Chart

SBID Stock Overview

| Market Cap in USD | 89,785m |

| Sector | Financial Services |

| Industry | Banks - Regional |

| GiC SubIndustry | Regional Banks |

| TER | 0.00% |

| IPO / Inception |

SBID Stock Ratings

| Growth 5y | 69.1 |

| Fundamental | 2.15 |

| Dividend | 49.6 |

| Rel. Performance vs Sector | 1.99 |

| Analysts | - |

| Fair Price Momentum | 106.15 USD |

| Fair Price DCF | 5156.75 USD |

SBID Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 37.93% |

| Payout Consistency | 79.2% |

SBID Growth Ratios

| Growth 12m | 36.91% |

| Growth Correlation 12m | 77% |

| Growth Correlation 3m | 60% |

| CAGR 5y | 16.18% |

| CAGR/Mean DD 5y | 1.14 |

| Sharpe Ratio 12m | 1.10 |

| Alpha vs SP500 12m | 16.96 |

| Beta vs SP500 5y weekly | 0.94 |

| ValueRay RSI | 26.18 |

| Volatility GJR Garch 1y | 27.82% |

| Price / SMA 50 | 1.05% |

| Price / SMA 200 | 18.08% |

| Current Volume | 3.8k |

| Average Volume 20d | 8k |

External Links for SBID Stock

What is the price of SBID stocks?

As of July 27, 2024, the stock is trading at USD 102.00 with a total of 3,837 shares traded.

Over the past week, the price has changed by -4.54%, over one month by +0.60%, over three months by +4.45% and over the past year by +35.57%.

As of July 27, 2024, the stock is trading at USD 102.00 with a total of 3,837 shares traded.

Over the past week, the price has changed by -4.54%, over one month by +0.60%, over three months by +4.45% and over the past year by +35.57%.

What are the forecast for SBID stock price target?

According to ValueRays Forecast Model, SBID State Bank of India will be worth about 118 in July 2025. The stock is currently trading at 102.00. This means that the stock has a potential upside of +15.68%.

According to ValueRays Forecast Model, SBID State Bank of India will be worth about 118 in July 2025. The stock is currently trading at 102.00. This means that the stock has a potential upside of +15.68%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 107.8 | 5.69 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 118 | 15.7 |