AZN - AstraZeneca PLC - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB0009895292

Cardiovascular, Oncology, Diabetes, Respiratory, Vaccines, Rare Disease

AstraZeneca PLC is a biopharmaceutical company that specializes in the discovery, development, manufacturing, and commercialization of prescription medicines. The company's primary focus is on creating innovative treatments that address various health conditions, improving patients' lives, and enhancing healthcare outcomes.

The company's portfolio of marketed products is extensive, with a range of medications targeting cardiovascular, renal, metabolism, and oncology diseases. Some of its notable products include Tagrisso, Imfinzi, Lynparza, Calquence, and Enhertu, which are used to treat various types of cancer, as well as Faslodex, Farxiga, Brilinta, and Lokelma, which are used to treat cardiovascular and metabolic disorders.

In addition to its oncology and cardiovascular portfolio, AstraZeneca also has a range of products for treating rare diseases, including Vaxzevria, Beyfortus, Synagis, and FluMist for COVID-19, as well as Soliris, Ultomiris, Strensiq, Koselugo, and Kanuma for rare genetic disorders.

AstraZeneca's global presence is significant, with a network of distributors and local representative offices in the United Kingdom, Europe, the Americas, Asia, Africa, and Australasia. This enables the company to reach primary care and specialty care physicians, providing them with access to its innovative medicines.

The company is committed to collaborative research and development, with partnerships in place with organizations such as Neurimmune AG, BenevolentAI, and Absci Corporation. These partnerships focus on developing new treatments for systemic lupus erythematosus, oncology, and other diseases, leveraging cutting-edge technologies like AI-driven drug discovery.

AstraZeneca has a rich history, dating back to 1992, when it was founded as Zeneca Group PLC. The company changed its name to AstraZeneca PLC in April 1999. Today, it is headquartered in Cambridge, United Kingdom, and continues to drive innovation in the biopharmaceutical industry.

For more information about AstraZeneca PLC, please visit its website at https://www.astrazeneca.com.

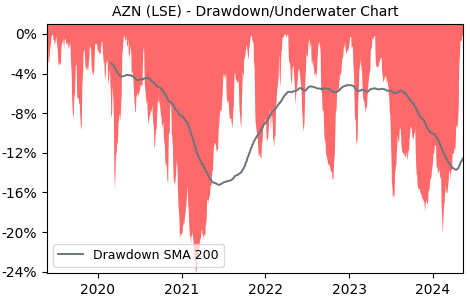

Drawdown (Underwater) Chart

AZN Stock Overview

| Market Cap in USD | 2,434m |

| Sector | Healthcare |

| Industry | Drug Manufacturers - General |

| GiC SubIndustry | Pharmaceuticals |

| TER | 0.00% |

| IPO / Inception | 1993-05-12 |

AZN Stock Ratings

| Growth 5y | 74.7 |

| Fundamental | 39.4 |

| Dividend | 44.8 |

| Rel. Performance vs Sector | -0.43 |

| Analysts | - |

| Fair Price Momentum | 12155.33 GBX |

| Fair Price DCF | 112.11 GBX |

AZN Dividends

| Dividend Yield 12m | 1.96% |

| Yield on Cost 5y | 3.61% |

| Dividends CAGR 5y | 1.41% |

| Payout Consistency | 98.2% |

AZN Growth Ratios

| Growth 12m | 15.60% |

| Growth Correlation 12m | 79.8% |

| Growth Correlation 3m | -62.4% |

| CAGR 5y | 12.96% |

| CAGR/Mean DD 5y | 1.61 |

| Sharpe Ratio 12m | 0.55 |

| Alpha vs SP500 12m | 2.07 |

| Beta vs SP500 5y weekly | 0.25 |

| ValueRay RSI | 47.71 |

| Volatility GJR Garch 1y | 19.72% |

| Price / SMA 50 | -3.19% |

| Price / SMA 200 | 3.46% |

| Current Volume | 544.2k |

| Average Volume 20d | 1882.7k |

External Links for AZN Stock

As of October 22, 2024, the stock is trading at GBX 11930.00 with a total of 544,215 shares traded.

Over the past week, the price has changed by -0.05%, over one month by +1.27%, over three months by -2.09% and over the past year by +17.32%.

According to ValueRays Forecast Model, AZN AstraZeneca PLC will be worth about 13127.8 in October 2025. The stock is currently trading at 11930.00. This means that the stock has a potential upside of +10.04%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 130.3 | -98.9 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 13127.8 | 10.0 |