BA - BAE Systems plc - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB0002634946

Defense, Aerospace, Security, Electronics, Cyber, Intelligence, Platforms

BAE Systems plc is a leading global defense, aerospace, and security company that provides a wide range of innovative solutions to its customers worldwide. The company's diverse portfolio is organized into five business segments: Electronic Systems, Platforms & Services, Air, Maritime, and Cyber & Intelligence.

The Electronic Systems segment is a key player in the development of advanced electronic warfare systems, navigation systems, and electro-optical sensors. It also provides critical components for military and commercial aircraft, including digital engine and flight controls, precision guidance and seeker solutions, and military communication systems. Additionally, the segment offers persistent surveillance capabilities, space electronics, and electric drive propulsion systems, making it a one-stop-shop for customers seeking cutting-edge electronic solutions.

The Cyber & Intelligence segment is at the forefront of modernizing, maintaining, and testing cyber-harden aircraft, radars, missile systems, and mission applications that detect and deter threats to national security. It also provides systems engineering, integration, and sustainment services for critical weapons systems, C5ISR, and cyber security. Furthermore, the segment offers data intelligence solutions to protect nations, businesses, and citizens from cyber threats, making it a trusted partner for governments and private organizations alike.

The Platforms & Services segment is a leading manufacturer and upgrader of combat vehicles, weapons, and munitions. It also provides naval ship repair services and manages government-owned ammunition plants, making it a critical component of the defense supply chain.

The Air segment is focused on developing future combat air systems and falconworks, pushing the boundaries of innovation in aerial warfare. Meanwhile, the Maritime segment provides a range of maritime and land activities, including submarine, ship build, and support programmes, making it a key player in the global naval defense industry.

With a rich history dating back to 1970, BAE Systems plc is headquartered in Camberley, the United Kingdom, and has established itself as a trusted partner for governments and private organizations worldwide. For more information, visit https://www.baesystems.com.

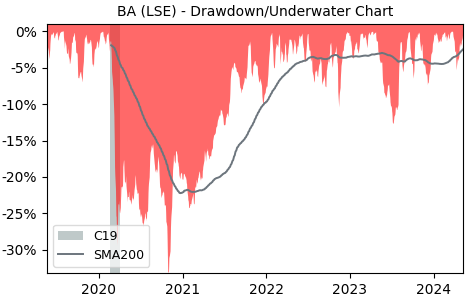

Drawdown (Underwater) Chart

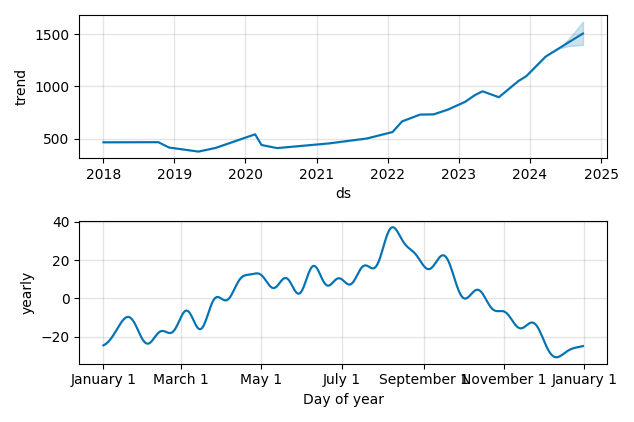

Overall Trend and Yearly Seasonality

BA Stock Overview

| Market Cap in USD | 503m |

| Sector | Industrials |

| Industry | Aerospace & Defense |

| GiC SubIndustry | Aerospace & Defense |

| TER | 0.00% |

| IPO / Inception | 1981-02-01 |

BA Stock Ratings

| Growth 5y | 91.4 |

| Fundamental | 74.2 |

| Dividend | 55.7 |

| Rel. Performance vs Sector | -0.44 |

| Analysts | - |

| Fair Price Momentum | 1340.03 GBX |

| Fair Price DCF | 38.72 GBX |

BA Dividends

| Dividend Yield 12m | 2.36% |

| Yield on Cost 5y | 6.85% |

| Dividends CAGR 5y | 4.45% |

| Payout Consistency | 98.7% |

BA Growth Ratios

| Growth 12m | 39.77% |

| Growth Correlation 12m | 76% |

| Growth Correlation 3m | -49% |

| CAGR 5y | 23.65% |

| CAGR/Mean DD 5y | 2.91 |

| Sharpe Ratio 12m | 1.72 |

| Alpha vs SP500 12m | 27.57 |

| Beta vs SP500 5y weekly | 0.44 |

| ValueRay RSI | 22.31 |

| Volatility GJR Garch 1y | 20.98% |

| Price / SMA 50 | -4.24% |

| Price / SMA 200 | 4.58% |

| Current Volume | 3960.2k |

| Average Volume 20d | 4154k |

External Links for BA Stock

As of July 27, 2024, the stock is trading at GBX 1272.50 with a total of 3,960,203 shares traded.

Over the past week, the price has changed by +0.20%, over one month by -4.18%, over three months by -5.04% and over the past year by +31.40%.

According to ValueRays Forecast Model, BA BAE Systems plc will be worth about 1464.7 in July 2025. The stock is currently trading at 1272.50. This means that the stock has a potential upside of +15.1%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 1402.2 | 10.2 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 1464.7 | 15.1 |