BHP Group Limited: History, Core and Side Businesses, and Market Status

History of BHP

BHP Group Limited, known as BHP, is a leading global resources company with a rich history dating back to the late 19th century. Founded in 1885 in Broken Hill, Australia, BHP began as a silver, lead, and zinc mining company. Over the years, it expanded its operations globally, diversifying into steel production and later focusing on iron ore, copper, coal, petroleum, and potash.

Core Businesses

The heart of BHP's operations lies in the extraction and processing of minerals and oil & gas. The company's primary commodities include iron ore, which is crucial for steelmaking; copper, essential for electrical applications; coal, used in electricity and steel production; petroleum, for fuel and petrochemicals; and potash, an essential fertilizer ingredient. With extensive operations in Australia, the Americas, and other parts of the world, BHP plays a significant role in supplying the raw materials necessary for global economic growth.

Side Businesses and Ventures

Beyond its core mining and petroleum operations, BHP has engaged in various side ventures and initiatives over the years. These include investments in technologies to reduce carbon emissions, water stewardship projects, and community programs focused on health, education, and local economic development. While these efforts are not the main revenue drivers for BHP, they are crucial for the company's commitment to sustainable and responsible resource extraction.

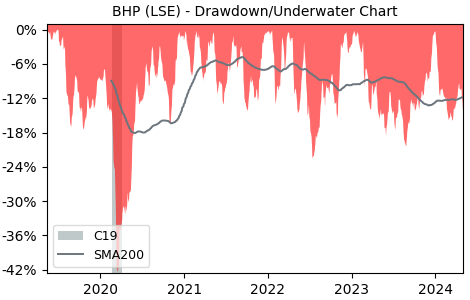

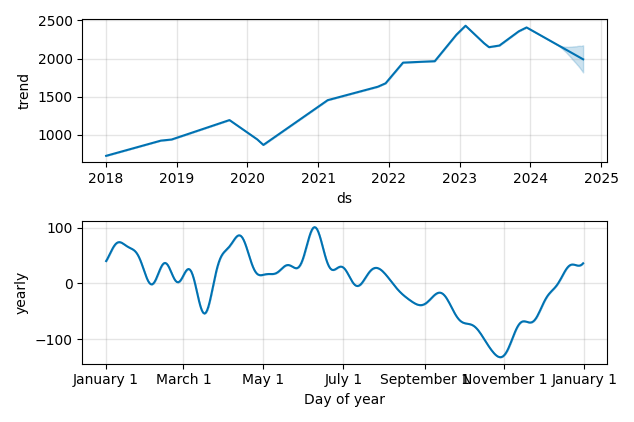

Current Market Status

As of the latest market analysis, BHP Group Limited stands as one of the largest mining companies worldwide by market capitalization. The company's strategic focus on high-demand commodities, efficient operations, and sustainability initiatives positions BHP well in the face of global economic fluctuations and the increasing demand for responsible resource extraction. The financial performance of BHP reflects its operational success and adaptability, making it a focal point for investors seeking stability and growth in the resources sector.