BVA - Banco Bilbao Vizcaya Argentaria S.A

Exchange: London Exchange • Country: Spain • Currency: EUR • Type: Common Stock • ISIN: -s

Banking, Loans, Insurance, Investments, Asset Management

Banco Bilbao Vizcaya Argentaria, S.A. is a leading financial institution that offers a wide range of services, including retail banking, wholesale banking, and asset management, to individuals and businesses across the globe.

The company's retail banking services include a variety of deposit products, such as savings accounts, demand deposits, and time deposits, as well as loan products like residential mortgages, credit card loans, and consumer finance. Additionally, it provides loans to enterprises and the public sector, catering to the diverse financial needs of its customers.

Banco Bilbao Vizcaya Argentaria's wholesale banking division offers specialized services to corporate, commercial, and SME clients, including payment systems, retail, private, and investment banking, as well as leasing and factoring. The company's insurance and asset management business provides pension and life insurance solutions, among other services.

In today's digital age, the company recognizes the importance of online and mobile channels, providing its customers with convenient and accessible ways to manage their finances and access its products and services.

With a rich history dating back to 1857, Banco Bilbao Vizcaya Argentaria, S.A. is headquartered in Bilbao, Spain, and has established itself as a prominent player in the global financial industry. For more information, visit their website at https://www.bbva.com.

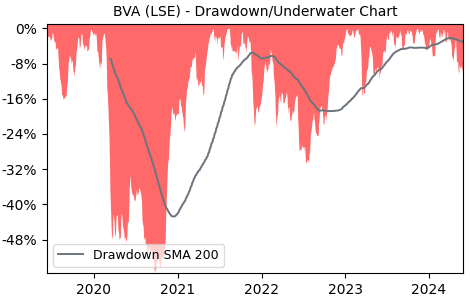

Drawdown (Underwater) Chart

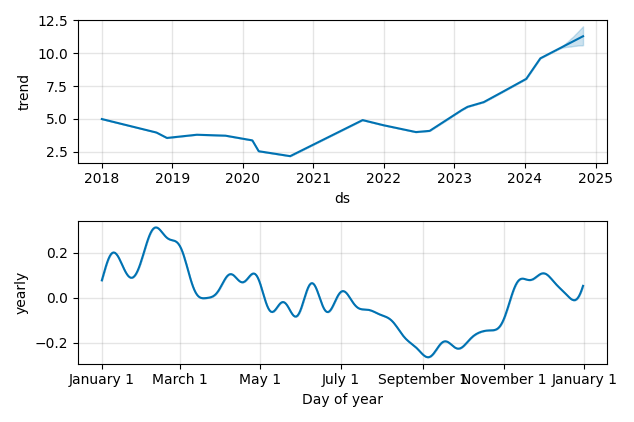

Overall Trend and Yearly Seasonality

BVA Stock Overview

| Market Cap in USD | 62,903m |

| Sector | Financial Services |

| Industry | Banks - Diversified |

| GiC SubIndustry | Regional Banks |

| TER | 0.00% |

| IPO / Inception |

BVA Stock Ratings

| Growth 5y | 77.7 |

| Fundamental | 9.64 |

| Dividend | 79.1 |

| Rel. Performance vs Sector | 1.25 |

| Analysts | - |

| Fair Price Momentum | 11.50 EUR |

| Fair Price DCF | 323.31 EUR |

BVA Dividends

| Dividend Yield 12m | 5.49% |

| Yield on Cost 5y | 15.11% |

| Dividends CAGR 5y | 12.57% |

| Payout Consistency | 87.4% |

BVA Growth Ratios

| Growth 12m | 55.07% |

| Growth Correlation 12m | 71% |

| Growth Correlation 3m | -5% |

| CAGR 5y | 22.25% |

| CAGR/Mean DD 5y | 1.61 |

| Sharpe Ratio 12m | 1.57 |

| Alpha vs SP500 12m | 32.70 |

| Beta vs SP500 5y weekly | 1.10 |

| ValueRay RSI | 67.17 |

| Volatility GJR Garch 1y | 31.88% |

| Price / SMA 50 | 4.59% |

| Price / SMA 200 | 12.08% |

| Current Volume | 0.6k |

| Average Volume 20d | 1374.6k |

External Links for BVA Stock

As of July 27, 2024, the stock is trading at EUR 10.02 with a total of 607 shares traded.

Over the past week, the price has changed by +1.37%, over one month by +9.69%, over three months by -5.87% and over the past year by +55.30%.

According to ValueRays Forecast Model, BVA Banco Bilbao Vizcaya Argentaria S.A will be worth about 12.4 in July 2025. The stock is currently trading at 10.02. This means that the stock has a potential upside of +23.95%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 12.4 | 24.0 |