DLAR - De La Rue PLC - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00B3DGH821

Banknotes, Security Features, Authentication Tokens, Identity Documents

De La Rue plc provides secure digital, physical, surety, and control solutions for government and commercial organization in the United Kingdom, the Middle East, Africa, Asia, the Americas, and internationally. It operates through Currency, Authentication, and Identity Solutions segments. The company offers currency solutions, which includes banknotes, design services, polymer substrate, and security features to central banks and issuing authorities. It also provides high security digital and physical solutions, which includes supply chain traceability, physical authentication tokens, and ID security components, as well as government revenue and brand protection solutions, as well as engages in trading and insurance activities. De La Rue plc was formerly known as New De La Rue plc and changed its name to De La Rue plc in November 1999. The company was founded in 1813 and is headquartered in Basingstoke, the United Kingdom. Web URL: https://www.delarue.com

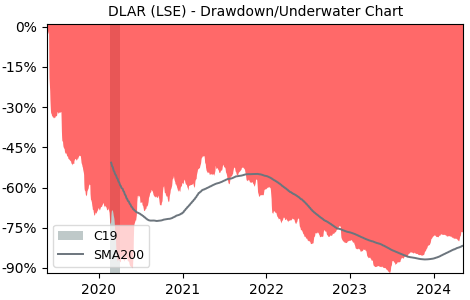

Drawdown (Underwater) Chart

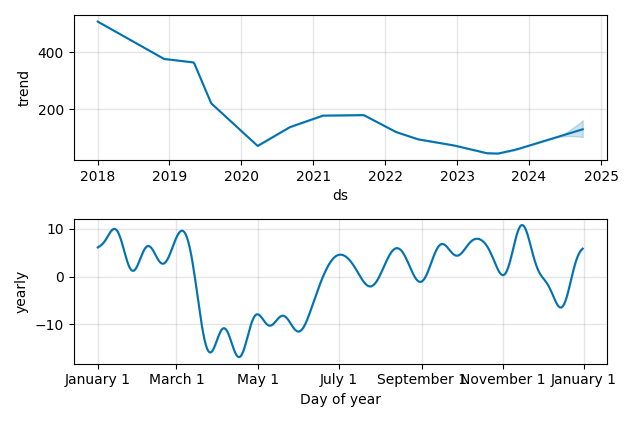

Overall Trend and Yearly Seasonality

DLAR Stock Overview

| Market Cap in USD | 3m |

| Sector | Industrials |

| Industry | Specialty Business Services |

| GiC SubIndustry | Commercial Printing |

| TER | 0.00% |

| IPO / Inception |

DLAR Stock Ratings

| Growth 5y | -29.4 |

| Fundamental | 33.6 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | 0.40 |

| Analysts | - |

| Fair Price Momentum | 116.32 GBX |

| Fair Price DCF | 1.22 GBX |

DLAR Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | -100.00% |

| Payout Consistency | 70.4% |

DLAR Growth Ratios

| Growth 12m | 114.58% |

| Growth Correlation 12m | 72% |

| Growth Correlation 3m | 33% |

| CAGR 5y | -14.23% |

| CAGR/Mean DD 5y | -0.31 |

| Sharpe Ratio 12m | 3.09 |

| Alpha vs SP500 12m | 87.92 |

| Beta vs SP500 5y weekly | 1.38 |

| ValueRay RSI | 75.94 |

| Volatility GJR Garch 1y | 44.88% |

| Price / SMA 50 | 5.75% |

| Price / SMA 200 | 23.37% |

| Current Volume | 791.1k |

| Average Volume 20d | 214.3k |

External Links for DLAR Stock

What is the price of DLAR stocks?

As of July 27, 2024, the stock is trading at GBX 103.00 with a total of 791,143 shares traded.

Over the past week, the price has changed by +5.75%, over one month by +3.62%, over three months by +14.96% and over the past year by +114.58%.

As of July 27, 2024, the stock is trading at GBX 103.00 with a total of 791,143 shares traded.

Over the past week, the price has changed by +5.75%, over one month by +3.62%, over three months by +14.96% and over the past year by +114.58%.

What are the forecast for DLAR stock price target?

According to ValueRays Forecast Model, DLAR De La Rue PLC will be worth about 131.7 in July 2025. The stock is currently trading at 103.00. This means that the stock has a potential upside of +27.9%.

According to ValueRays Forecast Model, DLAR De La Rue PLC will be worth about 131.7 in July 2025. The stock is currently trading at 103.00. This means that the stock has a potential upside of +27.9%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 102.5 | -0.49 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 131.7 | 27.9 |