FSJ - James Fisher and Sons PLC - Stock & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB0003395000

Marine Support, Oil and Gas, Renewable Energy, Ports and Terminals, Defence Services

James Fisher and Sons plc operates as an engineering services company worldwide. It operates through three segments: Energy, Defence, and Maritime Transport. It offers oil and gas solutions, such as decommissioning, digital twin, diving and remotely operated vehicle (ROV), heat suppression, hazardous area design and engineering, lifting and handling, marine, ship-to-ship transfer, and subsea services, as well as artificial lifts, compressors and breathing air systems, diving systems and equipment, offshore monitoring systems, and ROVs. The company also provides renewable solutions, including balance of plant, blade inspection and repair, cathodic protection replacement, digital operational planning and asset management, diving and ROV, excavation and trenching, high voltage testing, terminations, operations and maintenance, installation and commissioning, noise attenuation, subsea survey and inspection, subsea repair and maintenance, structural monitoring, and unexploded ordnance services, as well as mooring and fendering systems. In addition, it offers ports and terminals solutions, such as inspection and monitoring, offshore terminal, ship agency, and subsea services, as well as mooring and fendering equipment and services; transport and infrastructure solutions, including decommissioning, design and engineering, digital asset management, fuels infrastructure, engineering, inspection and monitoring, marine, ship and crew management, structural monitoring, and vessel chartering services; and solutions for defence, which include submarine rescue, special operation, naval vessel refueling, and radiological monitoring services, as well as submarine platforms and emergency oil spill response vessels. Further, the company operates ports in Plymouth, the United Kingdom. James Fisher and Sons plc was founded in 1847 and is based in Barrow-in-Furness, the United Kingdom. Web URL: https://www.james-fisher.com

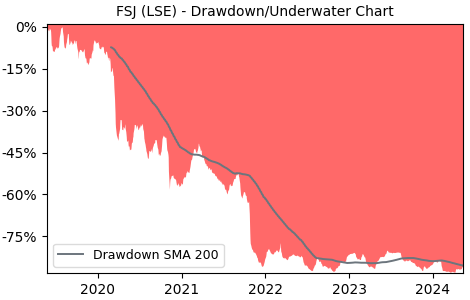

Drawdown (Underwater) Chart

FSJ Stock Overview

| Market Cap in USD | 2m |

| Sector | Industrials |

| Industry | Marine Shipping |

| GiC SubIndustry | Marine Ports & Services |

| TER | 0.00% |

| IPO / Inception |

FSJ Stock Ratings

| Growth 5y | -66.4 |

| Fundamental | 4.69 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | -0.30 |

| Analysts | - |

| Fair Price Momentum | 259.57 GBX |

| Fair Price DCF | 8.27 GBX |

FSJ Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | -100.00% |

| Payout Consistency | 79.7% |

FSJ Growth Ratios

| Growth 12m | -20.20% |

| Growth Correlation 12m | -23% |

| Growth Correlation 3m | 74% |

| CAGR 5y | -30.74% |

| CAGR/Mean DD 5y | -0.49 |

| Sharpe Ratio 12m | -0.64 |

| Alpha vs SP500 12m | -29.31 |

| Beta vs SP500 5y weekly | 0.24 |

| ValueRay RSI | 62.55 |

| Volatility GJR Garch 1y | 44.27% |

| Price / SMA 50 | 3.01% |

| Price / SMA 200 | 9.46% |

| Current Volume | 66.6k |

| Average Volume 20d | 49.5k |

External Links for FSJ Stock

What is the price of FSJ stocks?

As of July 27, 2024, the stock is trading at GBX 324.00 with a total of 66,647 shares traded.

Over the past week, the price has changed by +0.60%, over one month by +6.33%, over three months by +23.53% and over the past year by -16.42%.

As of July 27, 2024, the stock is trading at GBX 324.00 with a total of 66,647 shares traded.

Over the past week, the price has changed by +0.60%, over one month by +6.33%, over three months by +23.53% and over the past year by -16.42%.

What are the forecast for FSJ stock price target?

According to ValueRays Forecast Model, FSJ James Fisher and Sons PLC will be worth about 287.9 in July 2025. The stock is currently trading at 324.00. This means that the stock has a potential downside of -11.15%.

According to ValueRays Forecast Model, FSJ James Fisher and Sons PLC will be worth about 287.9 in July 2025. The stock is currently trading at 324.00. This means that the stock has a potential downside of -11.15%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 480 | 48.1 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 287.9 | -11.1 |