ISFU - iShares Core FTSE 100 - Stock & Dividends

Exchange: London Exchange • Country: UK • Currency: USD • Type: Etf • ISIN: IE0005042456 • UK Large-Cap Equity

Stocks, Bonds, UK Companies

The iShares Core FTSE 100 UCITS ETF GBP (Dist) is an exchange-traded fund (ETF) that tracks the performance of the UK's largest companies, as represented by the Morningstar UK All Cap TME NR GBP index.

This ETF is domiciled in Ireland, which means it is registered and regulated by the Irish financial authorities. This provides a layer of security and oversight for investors.

The fund is managed by BlackRock, one of the world's largest and most experienced asset managers. You can find more information about the company and its investment approach on their website at http://www.blackrock.com.

As a UCITS ETF, this fund is designed to provide broad diversification and liquidity, making it a popular choice for investors seeking to gain exposure to the UK stock market. The fund's distribution policy means that it pays out income to investors on a regular basis, which can be attractive for those seeking a regular income stream.

By tracking the Morningstar UK All Cap TME NR GBP index, the ETF provides investors with a comprehensive view of the UK stock market, covering a wide range of companies across various sectors and industries. This can help to spread risk and increase the potential for long-term growth.

Overall, the iShares Core FTSE 100 UCITS ETF GBP (Dist) offers a convenient and cost-effective way to invest in the UK stock market, with the added benefits of professional management and regulatory oversight.

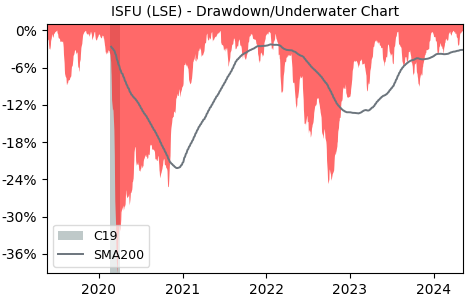

Drawdown (Underwater) Chart

ISFU ETF Overview

| Market Cap in USD | 11,796m |

| Category | UK Large-Cap Equity |

| TER | 0.07% |

| IPO / Inception | 2000-04-27 |

ISFU ETF Ratings

| Growth 5y | 47.0 |

| Fundamental | - |

| Dividend | 34.5 |

| Rel. Performance vs Sector | 0.08 |

| Analysts | - |

| Fair Price Momentum | 10.15 USD |

| Fair Price DCF | - |

ISFU Dividends

| Dividend Yield 12m | 3.72% |

| Yield on Cost 5y | 5.01% |

| Dividends CAGR 5y | -3.02% |

| Payout Consistency | 93.4% |

ISFU Growth Ratios

| Growth 12m | 13.09% |

| Growth Correlation 12m | 72% |

| Growth Correlation 3m | 20% |

| CAGR 5y | 6.10% |

| CAGR/Mean DD 5y | 0.78 |

| Sharpe Ratio 12m | 0.59 |

| Alpha vs SP500 12m | -6.47 |

| Beta vs SP500 5y weekly | 0.92 |

| ValueRay RSI | 60.12 |

| Volatility GJR Garch 1y | 12.64% |

| Price / SMA 50 | 1.47% |

| Price / SMA 200 | 9.17% |

| Current Volume | 83.2k |

| Average Volume 20d | 37.1k |

External Links for ISFU ETF

As of July 27, 2024, the stock is trading at USD 10.36 with a total of 83,226 shares traded.

Over the past week, the price has changed by +1.19%, over one month by +2.61%, over three months by +5.81% and over the past year by +15.17%.

According to ValueRays Forecast Model, ISFU iShares Core FTSE 100 will be worth about 11.3 in July 2025. The stock is currently trading at 10.36. This means that the stock has a potential upside of +8.88%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 11.3 | 8.88 |