Exploring UBS MSCI Japan Socially Responsible UCITS JPY A-dis

History and Evolution

UBS MSCI Japan Socially Responsible UCITS JPY A-dis is a fund designed for investors aiming to contribute positively to society while making their investments. It focuses on Japanese companies with exceptional environmental, social, and governance (ESG) ratings. The inception of this fund marked UBS's commitment to sustainable investing, aligning investors' financial goals with environmental and social impact.

Core and Side Businesses

The core business of the UBS MSCI Japan Socially Responsible UCITS fund is to invest in Japanese stocks that meet high ESG standards. It screens companies using rigorous ESG criteria, ensuring investments align with sustainable and socially responsible practices. Side businesses include financial advisory services and ESG consulting, helping companies and investors understand and improve their sustainability performance.

Current Market Status

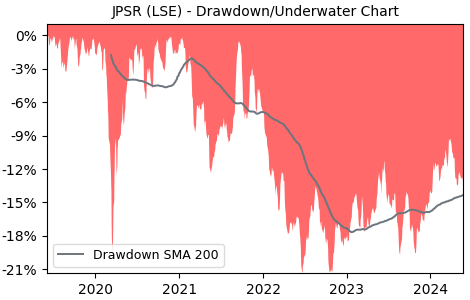

As of now, the UBS MSCI Japan Socially Responsible UCITS JPY A-dis continues to attract attention in the market. Its focus on ESG-compliant Japanese companies allows investors to contribute to societal welfare while seeking financial returns. The rising awareness of sustainable investing keeps it relevant in an ever-evolving investment landscape. However, like any investment, market conditions affect its performance, and investors are advised to consider their financial goals and risk tolerance when investing in funds such as this.