LCJD - Amundi MSCI Japan (DR) UCITS (USD)

Exchange: London Exchange • Country: UK • Currency: USD • Type: Etf • ISIN: LU1781541252 • Japan Large-Cap Equity

Japanese, Stocks, Equity, Index, Funds

The Amundi MSCI Japan (DR) UCITS ETF (USD) is an exchange-traded fund (ETF) listed on the London Stock Exchange (LSE) under the ticker symbol LCJD. This fund is designed to track the performance of the Japanese stock market, providing investors with exposure to the country's economy.

The ETF is domiciled in Luxembourg, a well-established hub for investment funds in Europe. This means that the fund is subject to the regulatory framework and laws of Luxembourg, which provides a high level of investor protection and oversight.

The ETF's underlying index is the MSCI Japan Index, which is a widely followed benchmark for Japanese equities. The index is designed to measure the performance of the Japanese stock market, covering a broad range of sectors and companies.

As a UCITS ETF, the Amundi MSCI Japan (DR) UCITS ETF (USD) is a European Union-regulated fund that adheres to strict guidelines and standards for investment funds. This ensures that the fund is transparent, liquid, and provides a high level of investor protection.

The fund's website can be found at https://first-eagle.amundi.com/, which provides detailed information on the fund's investment strategy, performance, and other relevant details.

By investing in the Amundi MSCI Japan (DR) UCITS ETF (USD), investors can gain exposure to the Japanese economy and benefit from the potential growth opportunities in the region. The fund's diversified portfolio and broad market coverage make it an attractive option for investors seeking to add Japanese equities to their investment portfolios.

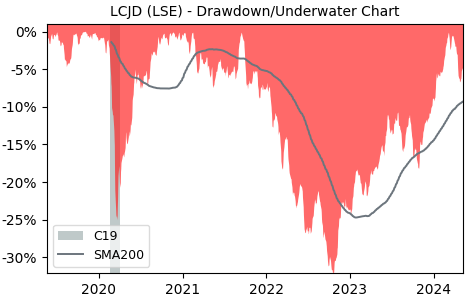

Drawdown (Underwater) Chart

LCJD ETF Overview

| Market Cap in USD | 506,754m |

| Category | Japan Large-Cap Equity |

| TER | 0.12% |

| IPO / Inception | 2018-02-28 |

LCJD ETF Ratings

| Growth 5y | 39.4 |

| Fundamental | - |

| Dividend | 0.00 |

| Rel. Performance vs Sector | -0.34 |

| Analysts | - |

| Fair Price Momentum | 17.09 USD |

| Fair Price DCF | - |

LCJD Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

LCJD Growth Ratios

| Growth 12m | 20.44% |

| Growth Correlation 12m | 78.1% |

| Growth Correlation 3m | 50.9% |

| CAGR 5y | 5.46% |

| CAGR/Mean DD 5y | 0.53 |

| Sharpe Ratio 12m | 0.89 |

| Alpha vs SP500 12m | -8.87 |

| Beta vs SP500 5y weekly | 0.68 |

| ValueRay RSI | 8.23 |

| Volatility GJR Garch 1y | 14.90% |

| Price / SMA 50 | -2.2% |

| Price / SMA 200 | 0.51% |

| Current Volume | 49k |

| Average Volume 20d | 94.2k |

External Links for LCJD ETF

As of October 22, 2024, the stock is trading at USD 17.79 with a total of 49,042 shares traded.

Over the past week, the price has changed by -3.19%, over one month by -3.22%, over three months by -1.81% and over the past year by +22.66%.

According to ValueRays Forecast Model, LCJD Amundi MSCI Japan (DR) UCITS (USD) will be worth about 18.8 in October 2025. The stock is currently trading at 17.79. This means that the stock has a potential upside of +5.62%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 18.8 | 5.62 |