Understanding the Lyxor Core MSCI Japan (DR) UCITS ETF (LCJP)

History and Background

The Lyxor Core MSCI Japan (DR) UCITS ETF, trading under the ticker LCJP on the London Stock Exchange, represents a focal initiative by Lyxor ETF to offer investors a streamlined pathway to engage with the Japanese equity market. Lyxor, a subsidiary of the Societe Generale group, has been a pioneer in the exchange-traded funds (ETF) arena, having launched its first ETF in 2001. The LCJP was introduced to provide a cost-effective and efficient investment vehicle that mirrors the performance of the MSCI Japan Index, encompassing a broad spectrum of Japanese companies.

Core Business and Operations

At its core, the LCJP ETF aims to replicate, to the extent possible, the performance of the MSCI Japan Index. This index is composed of large and mid-cap Japanese stocks, thereby providing a comprehensive snapshot of the Japanese market. The replication method employed by LCJP may involve direct investment in the underlying assets (Direct Replication) or the use of derivatives (Indirect Replication) to achieve its investment objective. As of my last knowledge update in April 2023, the fund has been inclined towards direct replication for enhanced transparency and alignment with the index performance.

A Look at Side Businesses and Investment Strategies

While the primary focus of LCJP remains tightly bound to tracking the MSCI Japan Index, Lyxor as a fund manager actively engages in securities lending. This practice involves lending out securities held by the ETF to qualified borrowers in exchange for a fee. This supplemental income can help in reducing the overall cost of the ETF to its investors, thereby potentially enhancing net returns. However, it's essential for investors to note that such practices carry certain risks, including but not limited to counterparty risk.

Current Market Status

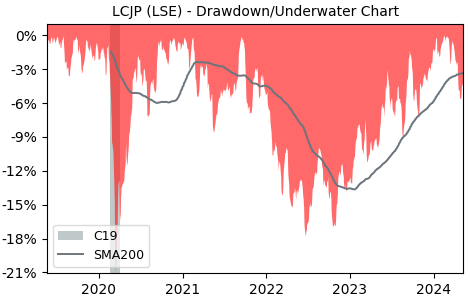

The Japanese equity market, represented by the MSCI Japan Index, has witnessed various cycles of growth and contraction, influenced by domestic and global economic conditions. The performance of LCJP closely follows these trends, offering investors an opportunity to gain exposure to Japan's economic dynamics. As markets evolve, the fund's strategy and holdings are periodically reviewed to ensure alignment with its investment objective, maintaining its relevance in changing market conditions.

Like any investment, the LCJP ETF carries risks, including market risk, currency fluctuations, and changes in the political and economic landscape of Japan. Potential investors are encouraged to conduct their due diligence or consult with financial advisors to understand these risks fully.