MONY - Moneysupermarket.Com Group PLC

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00B1ZBKY84

insurance, Money, Home Services, Travel, Cashback

MONY Group plc is a leading provider of price comparison and lead generation services in the United Kingdom, operating through a diverse range of segments including Insurance, Money, Home Services, Travel, and Cashback.

The company's flagship brand, MoneySuperMarket, is a popular price comparison site that offers online and app-based tools to help individuals save money on their household bills. Additionally, MONY Group plc owns MoneySavingExpert, a well-established consumer finance website that provides expert advice and resources to help people manage their finances effectively.

In the cashback space, the company operates Quidco, a cashback site that rewards customers for their online purchases. For travel enthusiasts, MONY Group plc offers TravelSupermarket, a comprehensive platform for comparing prices on a range of holiday options, including package holidays, hotels, low-cost and charter airlines, and car hire providers. Furthermore, the company owns icelolly.com, a holiday price comparison website and deals platform that helps users find the best travel deals.

Beyond its consumer-facing brands, MONY Group plc also provides industry-leading comparison technology to third-party brands through its B2B solution, Decision Tech. This enables other companies to offer price comparison services to their customers, further expanding MONY Group plc's reach and influence in the market.

With a rich history dating back to 1993, MONY Group plc is headquartered in Chester, the United Kingdom, and has undergone a significant transformation, including a name change from Moneysupermarket.com Group PLC to MONY Group plc in May 2024. Today, the company continues to innovate and evolve, driven by its mission to help people save money and make informed financial decisions.

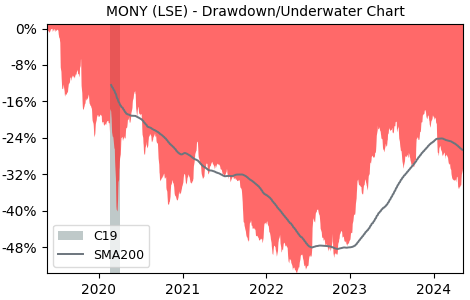

Drawdown (Underwater) Chart

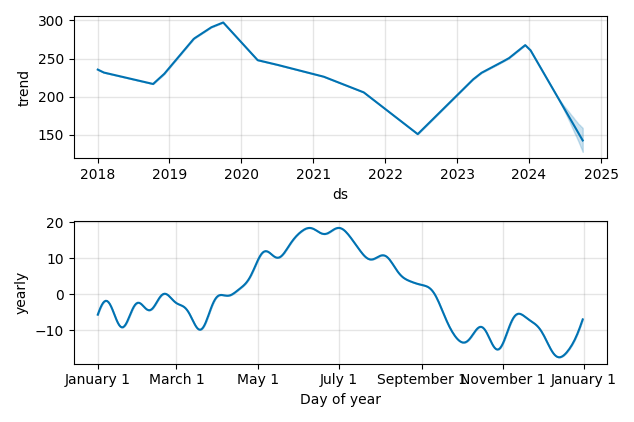

Overall Trend and Yearly Seasonality

MONY Stock Overview

| Market Cap in USD | 16m |

| Sector | Communication Services |

| Industry | Internet Content & Information |

| GiC SubIndustry | Internet & Direct Marketing Retail |

| TER | 0.00% |

| IPO / Inception | 2007-07-26 |

MONY Stock Ratings

| Growth 5y | -22.3 |

| Fundamental | 68.7 |

| Dividend | 34.2 |

| Rel. Performance vs Sector | -1.51 |

| Analysts | - |

| Fair Price Momentum | 201.20 GBX |

| Fair Price DCF | 6.74 GBX |

MONY Dividends

| Dividend Yield 12m | 5.37% |

| Yield on Cost 5y | 4.23% |

| Dividends CAGR 5y | -8.74% |

| Payout Consistency | 91.2% |

MONY Growth Ratios

| Growth 12m | -13.54% |

| Growth Correlation 12m | -34% |

| Growth Correlation 3m | 1% |

| CAGR 5y | -4.65% |

| CAGR/Mean DD 5y | -0.16 |

| Sharpe Ratio 12m | -0.71 |

| Alpha vs SP500 12m | -28.88 |

| Beta vs SP500 5y weekly | 0.64 |

| ValueRay RSI | 39.88 |

| Volatility GJR Garch 1y | 28.91% |

| Price / SMA 50 | -1.15% |

| Price / SMA 200 | -5.72% |

| Current Volume | 577.8k |

| Average Volume 20d | 666.7k |

External Links for MONY Stock

As of July 27, 2024, the stock is trading at GBX 225.40 with a total of 577,837 shares traded.

Over the past week, the price has changed by -0.97%, over one month by +0.45%, over three months by +4.45% and over the past year by -11.01%.

According to ValueRays Forecast Model, MONY Moneysupermarket.Com Group PLC will be worth about 222.1 in July 2025. The stock is currently trading at 225.40. This means that the stock has a potential downside of -1.48%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 287.2 | 27.4 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 222.1 | -1.48 |