OCDO - Ocado Group PLC - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00B3MBS747

Grocery, Logistics, Robotics, Automation, Software, Retail

Ocado Group plc is a pioneering online grocery retailer that operates in the United Kingdom and beyond. The company's diverse business is divided into three main segments: Technology Solutions, Ocado Logistics, and Ocado Retail.

The Technology Solutions segment is responsible for developing and licensing its cutting-edge software and robotics platform, known as the Ocado Smart Platform, to other retailers and businesses. This platform enables companies to efficiently manage their online grocery operations, from order taking to delivery. Additionally, Ocado Intelligent Automation offers its technology to non-grocery markets, allowing businesses to streamline their warehouse operations.

Ocado Logistics provides customer fulfillment centers and logistics services, ensuring that online orders are picked, packed, and delivered to customers efficiently. This segment is critical to the company's success, as it enables Ocado to maintain high levels of customer satisfaction and loyalty.

The Ocado Retail segment focuses on selling online groceries and general merchandise directly to consumers. The company has partnered with major retailers, such as Marks & Spencer, to offer a wide range of products to customers. Ocado's online retail platform provides a convenient and user-friendly shopping experience, complete with automated storage and retrieval solutions for general merchandise.

Founded in 2000, Ocado Group plc is headquartered in Hatfield, United Kingdom, and has established itself as a leader in the online grocery market. With its innovative technology and logistics capabilities, the company is well-positioned for continued growth and expansion.

For more information, visit Ocado Group plc's website at https://www.ocadogroup.com.

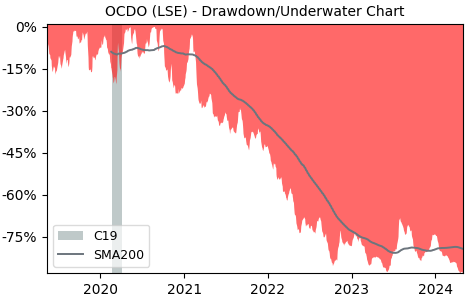

Drawdown (Underwater) Chart

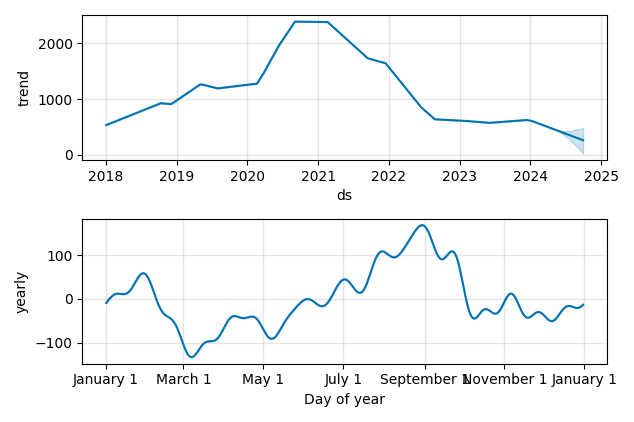

Overall Trend and Yearly Seasonality

OCDO Stock Overview

| Market Cap in USD | 38m |

| Sector | Consumer Defensive |

| Industry | Grocery Stores |

| GiC SubIndustry | Internet & Direct Marketing Retail |

| TER | 0.00% |

| IPO / Inception |

OCDO Stock Ratings

| Growth 5y | -63.6 |

| Fundamental | -51.2 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | -3.34 |

| Analysts | - |

| Fair Price Momentum | 346.46 GBX |

| Fair Price DCF | - |

OCDO Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

OCDO Growth Ratios

| Growth 12m | -52.44% |

| Growth Correlation 12m | -68% |

| Growth Correlation 3m | 6% |

| CAGR 5y | -18.65% |

| CAGR/Mean DD 5y | -0.39 |

| Sharpe Ratio 12m | -0.91 |

| Alpha vs SP500 12m | -68.54 |

| Beta vs SP500 5y weekly | 0.69 |

| ValueRay RSI | 90.64 |

| Volatility GJR Garch 1y | 88.73% |

| Price / SMA 50 | 26% |

| Price / SMA 200 | -6.65% |

| Current Volume | 3698.7k |

| Average Volume 20d | 4441.1k |

External Links for OCDO Stock

As of July 27, 2024, the stock is trading at GBX 445.90 with a total of 3,698,726 shares traded.

Over the past week, the price has changed by +17.93%, over one month by +58.68%, over three months by +26.28% and over the past year by -49.62%.

According to ValueRays Forecast Model, OCDO Ocado Group PLC will be worth about 377.2 in July 2025. The stock is currently trading at 445.90. This means that the stock has a potential downside of -15.42%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 619 | 38.8 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 377.2 | -15.4 |