ONT - Oxford Nanopore Technologies - Stock & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00BP6S8Z30

Nanopore Sequencers, DNA/RNA Analysis Tools, Sequencing Devices

Oxford Nanopore Technologies Ltd is a pioneering biotech company that has revolutionized the field of genetic analysis with its innovative nanopore-based sequencing platform. This cutting-edge technology enables real-time analysis of DNA and RNA, allowing researchers to gain valuable insights into the building blocks of life.

The company operates in two main segments: Life Science Research Tools and Covid Testing. Its product portfolio includes a range of portable and benchtop sequencers, such as MinION, GridION, and PromethION, which cater to different research needs and applications. These devices are designed to be flexible, scalable, and easy to use, making them accessible to researchers across various disciplines.

Oxford Nanopore's sequencing platform has far-reaching implications for scientific and biomedical research. It enables researchers to study human genetics, cancer, and infectious diseases, as well as environmental analysis, microbiome analysis, and crop science. The company's technology has also been instrumental in outbreak surveillance and antimicrobial resistance research, making it a crucial tool in the fight against global health threats.

In addition to its research tools, Oxford Nanopore offers a range of products for COVID-19 testing, including VolTRAX, an automated library prep system, and Q-Line, a sequencing solution for applied applications. These products have played a vital role in the global response to the pandemic, enabling rapid and accurate testing and surveillance.

Founded in 2005 and headquartered in Oxford, UK, Oxford Nanopore Technologies has established itself as a leader in the biotech industry. With its commitment to innovation and customer-centric approach, the company continues to push the boundaries of genetic analysis and make a meaningful impact on human health and well-being.

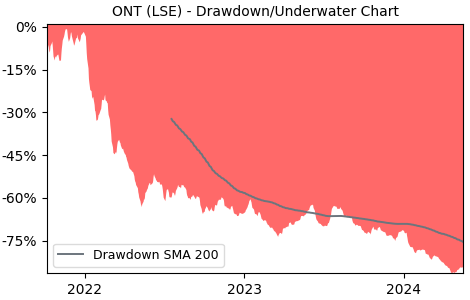

Drawdown (Underwater) Chart

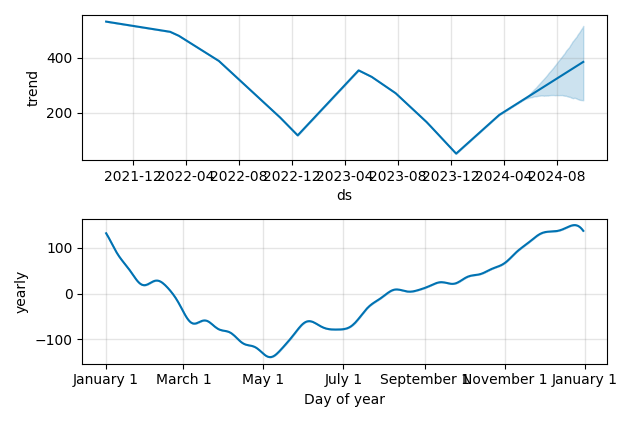

Overall Trend and Yearly Seasonality

ONT Stock Overview

| Market Cap in USD | 14m |

| Sector | Healthcare |

| Industry | Biotechnology |

| GiC SubIndustry | Biotechnology |

| TER | 0.00% |

| IPO / Inception |

ONT Stock Ratings

| Growth 5y | -73.7 |

| Fundamental | -71.6 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | -2.29 |

| Analysts | - |

| Fair Price Momentum | 89.34 GBX |

| Fair Price DCF | - |

ONT Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

ONT Growth Ratios

| Growth 12m | -49.96% |

| Growth Correlation 12m | -81% |

| Growth Correlation 3m | -9% |

| CAGR 5y | -42.15% |

| CAGR/Mean DD 5y | -0.70 |

| Sharpe Ratio 12m | -1.03 |

| Alpha vs SP500 12m | -68.37 |

| Beta vs SP500 5y weekly | 0.84 |

| ValueRay RSI | 98.25 |

| Volatility GJR Garch 1y | 48.55% |

| Price / SMA 50 | 24.15% |

| Price / SMA 200 | -10.55% |

| Current Volume | 1987.1k |

| Average Volume 20d | 1825k |

External Links for ONT Stock

As of July 27, 2024, the stock is trading at GBX 130.00 with a total of 1,987,110 shares traded.

Over the past week, the price has changed by +21.27%, over one month by +44.44%, over three months by +34.16% and over the past year by -48.86%.

According to ValueRays Forecast Model, ONT Oxford Nanopore Technologies will be worth about 98.9 in July 2025. The stock is currently trading at 130.00. This means that the stock has a potential downside of -23.9%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 187.4 | 44.2 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 98.9 | -23.9 |