PETS - Pets at Home Group Plc - Stock & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00BJ62K685

Pet Food, Pet Accessories, Pet Grooming, Veterinary Care, Pet Insurance

Pets at Home Group Plc is a leading specialist retailer of pet food, products, and accessories in the United Kingdom, offering a seamless shopping experience across its online and offline channels.

The company operates through three distinct segments: Retail, Vet Group, and Central. Its Retail segment offers a wide range of pet products, including food, toys, and accessories, as well as pet grooming services such as dog grooming, microchipping, and nail clipping. Additionally, the company provides pet insurance products and in-store consultations with trained pet nutritionists.

The Vet Group segment focuses on providing general veterinary care, triage services, and veterinary telehealth services, ensuring pets receive the best possible care. The company operates a network of pet care centers, stores, general practices, and grooming salons, offering customers a comprehensive range of services under one roof.

Through its online platform, Pets at Home Group Plc offers a convenient shopping experience, allowing customers to browse and purchase products, as well as book services, under its various brands, including Pet at Home, Vets for Pets, Pet Grooming, Pets Foundation, and Pets VIP Club.

Founded in 1991, Pets at Home Group Plc is headquartered in Handforth, the United Kingdom, and has established itself as a trusted name in the pet care industry, dedicated to providing high-quality products and services to pet owners across the country.

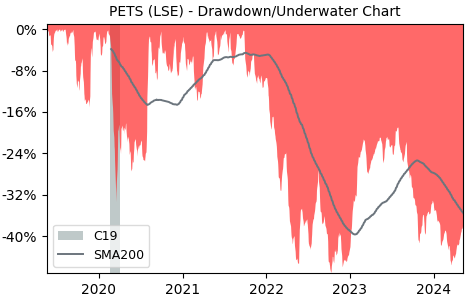

Drawdown (Underwater) Chart

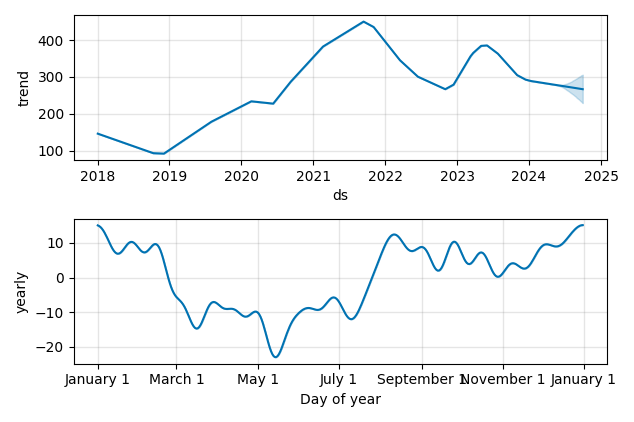

Overall Trend and Yearly Seasonality

PETS Stock Overview

| Market Cap in USD | 19m |

| Sector | Consumer Cyclical |

| Industry | Specialty Retail |

| GiC SubIndustry | Internet & Direct Marketing Retail |

| TER | 0.00% |

| IPO / Inception |

PETS Stock Ratings

| Growth 5y | 22.2 |

| Fundamental | 68.1 |

| Dividend | 70.0 |

| Rel. Performance vs Sector | - |

| Analysts | - |

| Fair Price Momentum | 283.15 GBX |

| Fair Price DCF | 11.41 GBX |

PETS Dividends

| Dividend Yield 12m | 4.13% |

| Yield on Cost 5y | 7.30% |

| Dividends CAGR 5y | 11.28% |

| Payout Consistency | 98.2% |

PETS Growth Ratios

| Growth 12m | -16.54% |

| Growth Correlation 12m | -32% |

| Growth Correlation 3m | 46% |

| CAGR 5y | 12.01% |

| CAGR/Mean DD 5y | 0.57 |

| Sharpe Ratio 12m | -0.69 |

| Alpha vs SP500 12m | -32.68 |

| Beta vs SP500 5y weekly | 0.70 |

| ValueRay RSI | 76.65 |

| Volatility GJR Garch 1y | 27.59% |

| Price / SMA 50 | 4.25% |

| Price / SMA 200 | 8.25% |

| Current Volume | 489.9k |

| Average Volume 20d | 1369.8k |

External Links for PETS Stock

As of July 27, 2024, the stock is trading at GBX 310.20 with a total of 489,905 shares traded.

Over the past week, the price has changed by +1.11%, over one month by +2.78%, over three months by +11.13% and over the past year by -13.32%.

According to ValueRays Forecast Model, PETS Pets at Home Group Plc will be worth about 312.5 in July 2025. The stock is currently trading at 310.20. This means that the stock has a potential upside of +0.73%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 370.6 | 19.5 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 312.5 | 0.73 |