RCP - RIT Capital Partners - Stock & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB0007366395

Stocks, Currencies, Private Equity, Funds

RIT Capital Partners Plc is a self-managed investment trust that takes a diversified approach to investing in the global markets. The firm's portfolio spans across public equities and currencies, as well as private investments and equity funds, with a focus on generating long-term returns.

The trust's investment strategy is guided by a top-down approach, where macroeconomic trends and market analysis inform its investment decisions. This approach enables the firm to identify opportunities and risks across various sectors and geographies, and to allocate its assets accordingly.

RIT Capital Partners' performance is benchmarked against two key indices: the RPI plus 3%, which reflects the firm's goal of delivering returns above inflation, and the MSCI All Country World Index (50% Sterling), which provides a broad measure of global equity market performance.

The trust's investment portfolio is diversified across various sectors, including but not limited to technology, healthcare, finance, and consumer goods. This diversification aims to minimize risk and maximize returns over the long term.

With a rich history dating back to August 1, 1988, RIT Capital Partners Plc is headquartered in London, United Kingdom. The firm is committed to delivering strong investment performance and creating long-term value for its shareholders. For more information, please visit their website at https://www.ritcap.co.uk.

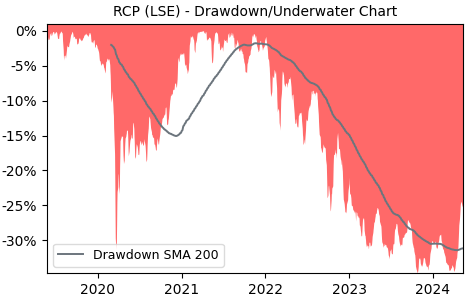

Drawdown (Underwater) Chart

RCP Stock Overview

| Market Cap in USD | 34m |

| Sector | Financial Services |

| Industry | Asset Management |

| GiC SubIndustry | Asset Management & Custody Banks |

| TER | 0.00% |

| IPO / Inception |

RCP Stock Ratings

| Growth 5y | -0.41 |

| Fundamental | 27.2 |

| Dividend | 48.9 |

| Rel. Performance vs Sector | -3.55 |

| Analysts | - |

| Fair Price Momentum | 1646.77 GBX |

| Fair Price DCF | 21.03 GBX |

RCP Dividends

| Dividend Yield 12m | 2.14% |

| Yield on Cost 5y | 2.01% |

| Dividends CAGR 5y | 2.25% |

| Payout Consistency | 92.6% |

RCP Growth Ratios

| Growth 12m | 6.70% |

| Growth Correlation 12m | 41.3% |

| Growth Correlation 3m | -60.7% |

| CAGR 5y | -1.24% |

| CAGR/Mean DD 5y | -0.07 |

| Sharpe Ratio 12m | 0.13 |

| Alpha vs SP500 12m | -21.65 |

| Beta vs SP500 5y weekly | 0.66 |

| ValueRay RSI | 69.66 |

| Volatility GJR Garch 1y | 15.72% |

| Price / SMA 50 | 1.13% |

| Price / SMA 200 | 0.61% |

| Current Volume | 277.5k |

| Average Volume 20d | 212.8k |

External Links for RCP Stock

As of October 22, 2024, the stock is trading at GBX 1820.00 with a total of 277,544 shares traded.

Over the past week, the price has changed by +3.53%, over one month by +0.42%, over three months by -1.20% and over the past year by +7.56%.

According to ValueRays Forecast Model, RCP RIT Capital Partners will be worth about 1830.1 in October 2025. The stock is currently trading at 1820.00. This means that the stock has a potential upside of +0.55%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 1095 | -39.8 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 1830.1 | 0.55 |