VanEck Semiconductor UCITS (SMH) - Stock & Dividends

Exchange: London Exchange • Country: UK • Currency: USD • Type: Etf • ISIN: IE00BMC38736 • Sector Equity Technology

VanEck Semiconductor UCITS ETF (LSE:SMH) is an exchange-traded fund (ETF) that tracks the performance of the Morningstar Global Technology Total Market Net Return USD Index.

This ETF is domiciled in Ireland, which means it is registered and regulated under Irish law, providing a secure and stable investment environment.

The fund's underlying index, the Morningstar Global Technology Total Market Net Return USD Index, is a comprehensive benchmark that covers a wide range of technology companies from around the world, including semiconductor manufacturers, software developers, and internet companies.

By investing in the VanEck Semiconductor UCITS ETF, investors can gain exposure to a diversified portfolio of technology companies, providing a convenient way to tap into the growth potential of the global technology sector.

As a UCITS-compliant ETF, the fund is designed to provide a high level of transparency, liquidity, and regulatory oversight, making it an attractive option for investors seeking to invest in the technology sector.

VanEck, the fund's issuer, is a well-established global investment management firm with a strong track record of providing innovative and diversified investment solutions.

With the VanEck Semiconductor UCITS ETF, investors can benefit from the expertise of a seasoned investment manager and gain exposure to a dynamic and rapidly evolving sector, while also enjoying the convenience and flexibility of an ETF structure.

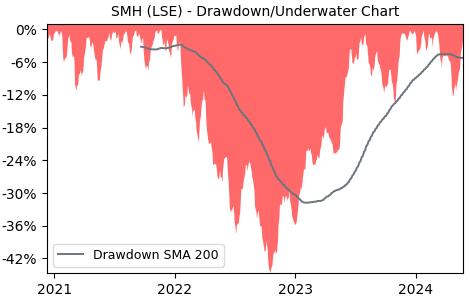

Drawdown (Underwater) Chart

SMH ETF Overview

| Market Cap in USD | 1,810m |

| Category | Sector Equity Technology |

| TER | 0.35% |

| IPO / Inception | 2020-12-01 |

SMH ETF Ratings

| Growth 5y | 6.75 |

| Fundamental | - |

| Dividend | - |

| Rel. Performance vs Sector | 2.32 |

| Analysts | - |

| Fair Price Momentum | 42.10 USD |

| Fair Price DCF | - |

SMH Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

SMH Growth Ratios

| Growth 12m | 65.77% |

| Growth Correlation 12m | 62% |

| Growth Correlation 3m | -1% |

| CAGR 5y | 23.52% |

| CAGR/Mean DD 5y | 1.85 |

| Sharpe Ratio 12m | 2.16 |

| Alpha vs SP500 12m | 29.33 |

| Beta vs SP500 5y weekly | 1.35 |

| ValueRay RSI | 76.12 |

| Volatility GJR Garch 1y | 29.26% |

| Price / SMA 50 | 4.04% |

| Price / SMA 200 | 25.51% |

| Current Volume | 26.3k |

| Average Volume 20d | 124.3k |

External Links for SMH ETF

As of May 18, 2024, the stock is trading at USD 41.67 with a total of 26,258 shares traded.

Over the past week, the price has changed by +3.66%, over one month by +7.00%, over three months by +9.38% and over the past year by +71.29%.

According to ValueRays Forecast Model, SMH VanEck Semiconductor UCITS will be worth about 47.4 in May 2025. The stock is currently trading at 41.67. This means that the stock has a potential upside of +13.65%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 47.4 | 13.7 |