THG - THG Holdings PLC - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00BMTV7393

Skincare, Haircare, Cosmetics, Sports Nutrition, Vitamins, Snacks

THG Plc is a cutting-edge e-commerce technology company that operates globally, with a strong presence in the United Kingdom, the United States, Europe, and other international markets.

The company's business is divided into three main segments: THG Beauty, THG Nutrition, and THG Ingenuity. THG Beauty is a leading manufacturer and retailer of a wide range of products, including skincare, haircare, cosmetics, body care, and fragrances. This segment also operates luxurious spa and experience venues, as well as high-end clothing and homeware stores. THG Beauty's products are available through popular websites such as Lookfantastic, Dermstore, and Cult Beauty.

THG Nutrition focuses on providing high-quality sports nutrition, vegan products, vitamins, bars, snacks, and sportswear under well-known brands like Myprotein, Myvegan, Myvitamins, MP Activewear, and MyPRO. This segment caters to the growing demand for healthy and sustainable living.

THG Ingenuity is the company's digital commerce solutions arm, offering a range of services including website development, media-related services, procurement, online advertising, franchising, and consultancy services. This segment also operates a hairdressing salon business, warehouses, and distribution centers, as well as provides manufacturing services, translation and interpretation services, and financial and business newspaper services.

In addition to its core business, THG Plc is involved in various other activities, such as website development, environmental consulting, motion picture distribution, metal recovery, and visual content production. The company has a diverse portfolio of businesses, which enables it to stay ahead of the curve in the rapidly evolving e-commerce landscape.

Founded in 2004, THG Plc has undergone significant transformations, including a name change from THG Holdings plc to THG Plc in January 2021. Headquartered in Altrincham, United Kingdom, the company continues to innovate and expand its operations globally.

For more information, please visit THG Plc's website at https://www.thg.com.

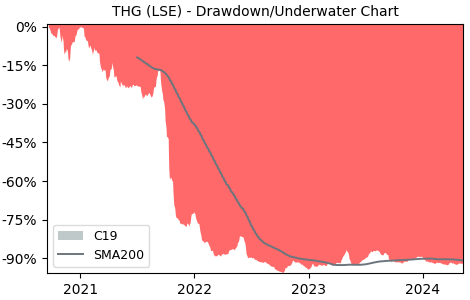

Drawdown (Underwater) Chart

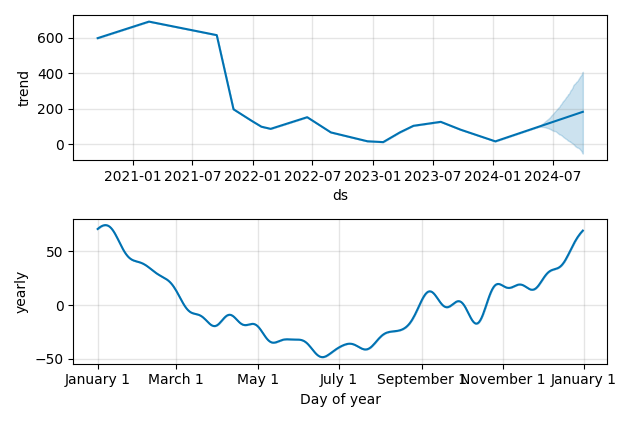

Overall Trend and Yearly Seasonality

THG Stock Overview

| Market Cap in USD | 11m |

| Sector | Consumer Cyclical |

| Industry | Internet Retail |

| GiC SubIndustry | Internet & Direct Marketing Retail |

| TER | 0.00% |

| IPO / Inception |

THG Stock Ratings

| Growth 5y | -65.5 |

| Fundamental | -34.2 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | -1.05 |

| Analysts | - |

| Fair Price Momentum | 46.70 GBX |

| Fair Price DCF | 1.20 GBX |

THG Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

THG Growth Ratios

| Growth 12m | -35.66% |

| Growth Correlation 12m | -42% |

| Growth Correlation 3m | -20% |

| CAGR 5y | -44.19% |

| CAGR/Mean DD 5y | -0.64 |

| Sharpe Ratio 12m | -0.73 |

| Alpha vs SP500 12m | -61.40 |

| Beta vs SP500 5y weekly | 1.32 |

| ValueRay RSI | 50.88 |

| Volatility GJR Garch 1y | 52.63% |

| Price / SMA 50 | -4.15% |

| Price / SMA 200 | -5.72% |

| Current Volume | 1485k |

| Average Volume 20d | 2008.7k |

External Links for THG Stock

As of July 27, 2024, the stock is trading at GBX 64.40 with a total of 1,484,961 shares traded.

Over the past week, the price has changed by +1.82%, over one month by +2.96%, over three months by +0.55% and over the past year by -36.05%.

According to ValueRays Forecast Model, THG THG Holdings PLC will be worth about 52.2 in July 2025. The stock is currently trading at 64.40. This means that the stock has a potential downside of -18.94%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 118.1 | 83.4 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 52.2 | -18.9 |