VOD - Vodafone Group PLC - Stock Price & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00BH4HKS39

Telecom Services, Internet, Mobile, Broadband, Cloud, IoT, Financial Services

Vodafone Group PLC is a leading telecommunications company that operates in Germany, the United Kingdom, and other parts of Europe, as well as Turkey and Africa. The company provides a wide range of services, including mobile and fixed connectivity, cloud and edge computing, and unified communications solutions.

One of its key offerings is Vodafone Business UC with RingCentral, a flexible and mobile-friendly platform that integrates various communication apps into a single system. This allows businesses to streamline their communication processes and improve collaboration. Additionally, the company provides a range of digital applications, IoT business solutions, and cybersecurity services to help businesses stay connected and protected.

Vodafone also offers a variety of devices, including mobile broadband devices, fixed devices, mobiles, tablets, and other gadgets. Its fixed broadband and WiFi services provide fast and reliable internet connectivity, while its V by Vodafone range of smart devices helps customers stay connected with the people and things that matter most.

The company's entertainment offerings include Vodafone Television, an internet video product, and Vodafone Pass, which allows customers to access chats, music, and streaming entertainment without worrying about data limits. Furthermore, its M-PESA mobile money platform provides financial services and payment solutions to customers in Africa.

Vodafone serves a diverse range of customers across various industries, including healthcare, banking and finance, transport and logistics, retail, utilities, and agriculture. With a strong presence in multiple markets, the company is well-positioned to meet the evolving needs of its customers.

Founded in 1984, Vodafone Group PLC is headquartered in Newbury, United Kingdom, and has a strong online presence through its website, https://www.vodafone.com.

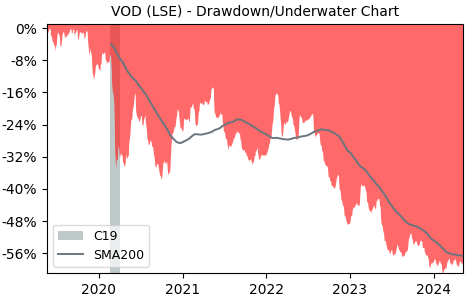

Drawdown (Underwater) Chart

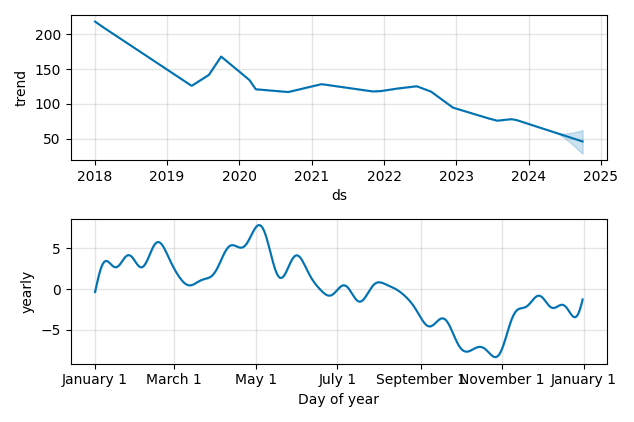

Overall Trend and Yearly Seasonality

VOD Stock Overview

| Market Cap in USD | 249m |

| Sector | Communication Services |

| Industry | Telecom Services |

| GiC SubIndustry | Wireless Telecommunication Services |

| TER | 0.00% |

| IPO / Inception | 1988-10-25 |

VOD Stock Ratings

| Growth 5y | -53.5 |

| Fundamental | 37.2 |

| Dividend | 45.9 |

| Rel. Performance vs Sector | -0.34 |

| Analysts | - |

| Fair Price Momentum | 61.95 GBX |

| Fair Price DCF | 7.09 GBX |

VOD Dividends

| Dividend Yield 12m | 10.50% |

| Yield on Cost 5y | 5.08% |

| Dividends CAGR 5y | 2.13% |

| Payout Consistency | 81.9% |

VOD Growth Ratios

| Growth 12m | -0.76% |

| Growth Correlation 12m | -23% |

| Growth Correlation 3m | -2% |

| CAGR 5y | -13.47% |

| CAGR/Mean DD 5y | -0.41 |

| Sharpe Ratio 12m | -0.24 |

| Alpha vs SP500 12m | -13.20 |

| Beta vs SP500 5y weekly | 0.46 |

| ValueRay RSI | 87.57 |

| Volatility GJR Garch 1y | 25.29% |

| Price / SMA 50 | 1.94% |

| Price / SMA 200 | 4.02% |

| Current Volume | 50552.2k |

| Average Volume 20d | 68343.2k |

External Links for VOD Stock

As of July 27, 2024, the stock is trading at GBX 73.22 with a total of 50,552,184 shares traded.

Over the past week, the price has changed by +3.86%, over one month by +5.02%, over three months by +6.06% and over the past year by -0.79%.

According to ValueRays Forecast Model, VOD Vodafone Group PLC will be worth about 68.1 in July 2025. The stock is currently trading at 73.22. This means that the stock has a potential downside of -7.02%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 1 | -98.6 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 68.1 | -7.02 |