BGNE - BeiGene - Stock Price & Dividends

Exchange: USA Stocks • Country: Cayman Islands • Currency: USD • Type: Common Stock • ISIN: US07725L1026

Cancer, Immunotherapy, Antibody, Inhibitor, Treatment

BeiGene Ltd is a biotech company focused on developing innovative treatments for cancer patients worldwide. Its portfolio includes commercial-stage products such as BRUKINSA, a small molecule inhibitor of Bruton's Tyrosine Kinase (BTK) for treating blood cancers, and TEVIMBRA, an anti-PD-1 antibody immunotherapy for solid tumor and blood cancers. Additionally, the company has PARTRUVIX, a selective small molecule inhibitor of PARP1 and PARP2 enzymes, which is being evaluated as a monotherapy and in combinations for solid tumors.

The company's clinical-stage pipeline is robust, with multiple candidates in various stages of development. These include BGB-11417, a small molecule Bcl-2 inhibitor; BGB-16673, a BTK-targeting chimeric degradation activation compound; and Ociperlimab (BGB-A1217), a TIGIT inhibitor. Other notable candidates include Zanidatamab, a bispecific HER2-targeted antibody, and Surzebiclimab (BGB-A425), a TIM-3 inhibitor. The company is also exploring various preclinical programs, demonstrating its commitment to advancing cancer treatment options.

BeiGene has established strategic partnerships with several companies, including Ensem Therapeutics, Shandong Luye Pharmaceutical, and Amgen, to name a few. These collaborations enable the company to leverage its expertise and resources to accelerate the development of its pipeline. Founded in 2010, BeiGene is headquartered in Camana Bay, the Cayman Islands, and has a strong online presence at https://www.beigene.com.

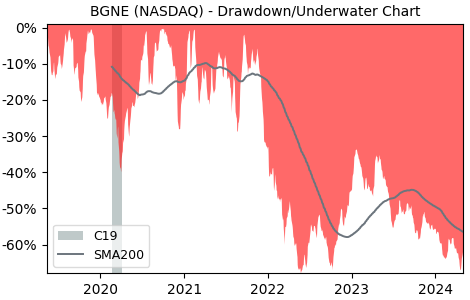

Drawdown (Underwater) Chart

Overall Trend and Yearly Seasonality

BGNE Stock Overview

| Market Cap in USD | 27,276m |

| Sector | Healthcare |

| Industry | Biotechnology |

| GiC SubIndustry | Biotechnology |

| TER | 0.00% |

| IPO / Inception | 2016-02-03 |

BGNE Stock Ratings

| Growth 5y | 10.1 |

| Fundamental | -47.8 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | -1.60 |

| Analysts | 4.55/5 |

| Fair Price Momentum | 245.85 USD |

| Fair Price DCF | - |

BGNE Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

BGNE Growth Ratios

| Growth 12m | 30.34% |

| Growth Correlation 12m | 16.9% |

| Growth Correlation 3m | 91.9% |

| CAGR 5y | 9.59% |

| CAGR/Mean DD 5y | 0.27 |

| Sharpe Ratio 12m | 0.56 |

| Alpha vs SP500 12m | -5.88 |

| Beta vs SP500 5y weekly | 0.88 |

| ValueRay RSI | 52.11 |

| Volatility GJR Garch 1y | 44.09% |

| Price / SMA 50 | 5.77% |

| Price / SMA 200 | 29.46% |

| Current Volume | 187.9k |

| Average Volume 20d | 395.3k |

External Links for BGNE Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of October 22, 2024, the stock is trading at USD 219.92 with a total of 187,949 shares traded.

Over the past week, the price has changed by -3.14%, over one month by +8.88%, over three months by +36.66% and over the past year by +27.15%.

According to ValueRays Forecast Model, BGNE BeiGene will be worth about 271.2 in October 2025. The stock is currently trading at 219.92. This means that the stock has a potential upside of +23.33%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 274.6 | 24.9 |

| Analysts Target Price | 292.5 | 33.0 |

| ValueRay Target Price | 271.2 | 23.3 |