CHK - Chesapeake Energy - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US1651677353

Oil, Natural Gas, Natural Gas Liquids

Chesapeake Energy Corporation is a leading independent exploration and production company in the United States, focused on discovering and extracting oil, natural gas, and natural gas liquids from underground reservoirs.

The company's primary strategy involves acquiring, exploring, and developing properties to tap into the country's vast natural gas resources. Its portfolio includes interests in prominent natural gas resource plays, such as the Marcellus Shale in the northern Appalachian Basin in Pennsylvania and the Haynesville/Bossier Shales in northwestern Louisiana.

As of December 31, 2023, Chesapeake Energy Corporation boasts an extensive portfolio of onshore U.S. unconventional natural gas assets, comprising interests in approximately 5,000 natural gas wells. This impressive asset base enables the company to capitalize on the growing demand for clean-burning natural gas in the United States.

Founded in 1989, Chesapeake Energy Corporation has established itself as a major player in the U.S. energy industry, with its headquarters located in Oklahoma City, Oklahoma. For more information about the company, visit their website at https://www.chk.com.

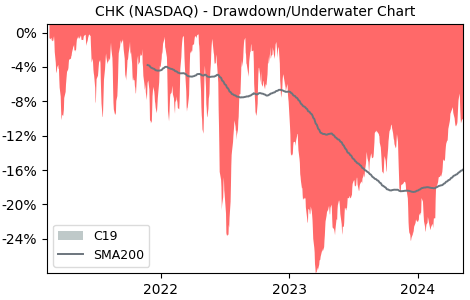

Drawdown (Underwater) Chart

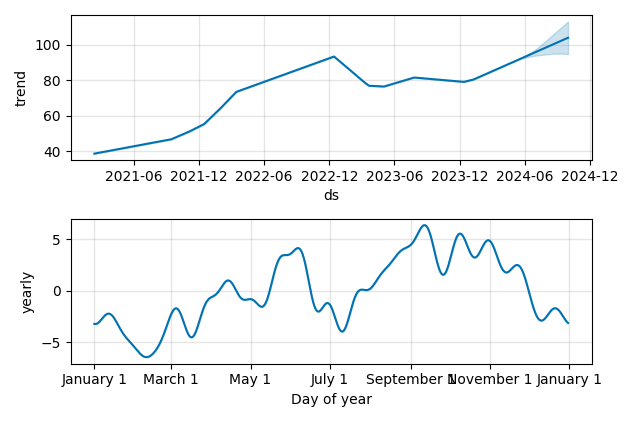

Overall Trend and Yearly Seasonality

CHK Stock Overview

| Market Cap in USD | 10,662m |

| Sector | Energy |

| Industry | Oil & Gas E&P |

| GiC SubIndustry | Oil & Gas Exploration & Production |

| TER | 0.00% |

| IPO / Inception | 1993-02-04 |

CHK Stock Ratings

| Growth 5y | 66.0 |

| Fundamental | 24.6 |

| Dividend | 48.7 |

| Rel. Performance vs Sector | -0.59 |

| Analysts | 4.00/5 |

| Fair Price Momentum | 70.19 USD |

| Fair Price DCF | 58.34 USD |

CHK Dividends

| Dividend Yield 12m | 3.15% |

| Yield on Cost 5y | 6.51% |

| Dividends CAGR 5y | 47.54% |

| Payout Consistency | 84.0% |

CHK Growth Ratios

| Growth 12m | -3.03% |

| Growth Correlation 12m | 15% |

| Growth Correlation 3m | -63% |

| CAGR 5y | 23.36% |

| CAGR/Mean DD 5y | 2.19 |

| Sharpe Ratio 12m | -0.35 |

| Alpha vs SP500 12m | -17.12 |

| Beta vs SP500 5y weekly | 0.57 |

| ValueRay RSI | 3.19 |

| Volatility GJR Garch 1y | 18.36% |

| Price / SMA 50 | -9.6% |

| Price / SMA 200 | -6.28% |

| Current Volume | 1840.7k |

| Average Volume 20d | 1612.4k |

External Links for CHK Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of July 27, 2024, the stock is trading at USD 77.40 with a total of 1,840,690 shares traded.

Over the past week, the price has changed by -4.84%, over one month by -7.44%, over three months by -14.71% and over the past year by -5.70%.

According to ValueRays Forecast Model, CHK Chesapeake Energy will be worth about 76.7 in July 2025. The stock is currently trading at 77.40. This means that the stock has a potential downside of -0.97%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 104.8 | 35.5 |

| Analysts Target Price | 107 | 38.2 |

| ValueRay Target Price | 76.7 | -0.97 |