QRTEA - Qurate Retail Series A - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US74915M1009

Apparel, Home, Accessories, Beauty Products

Qurate Retail, Inc., together with its subsidiaries, engages in the video and online commerce industries in North America, Europe, and Asia. The company markets and sells various consumer products primarily through merchandise-focused televised shopping programs, Internet, and mobile applications. It also operates as an online retailer offering women's, children's, and men's apparel; and other products, such as home, accessories, and beauty products through its app, mobile, and desktop applications. The company serves various homes through multiple streaming services, social pages, websites, print catalogs, and in-store destinations. The company was formerly known as Liberty Interactive Corporation and changed its name to Qurate Retail, Inc. in April 2018. Qurate Retail, Inc. was founded in 1991 and is headquartered in Englewood, Colorado. Web URL: https://www.qurateretail.com

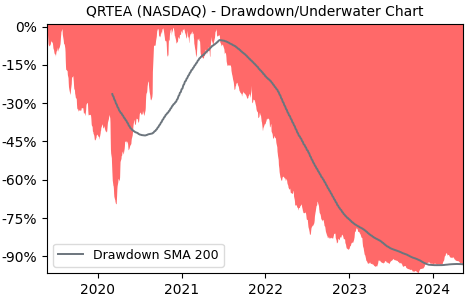

Drawdown (Underwater) Chart

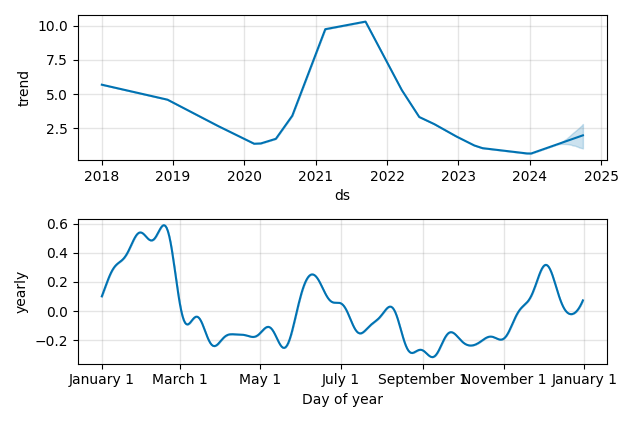

Overall Trend and Yearly Seasonality

QRTEA Stock Overview

| Market Cap in USD | 289m |

| Sector | Consumer Cyclical |

| Industry | Internet Retail |

| GiC SubIndustry | Broadline Retail |

| TER | 0.00% |

| IPO / Inception | 2006-05-10 |

QRTEA Stock Ratings

| Growth 5y | -49.5 |

| Fundamental | -6.20 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | -2.10 |

| Analysts | 3.00/5 |

| Fair Price Momentum | 0.61 USD |

| Fair Price DCF | 35.81 USD |

QRTEA Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | -100.00% |

| Payout Consistency | 15.6% |

QRTEA Growth Ratios

| Growth 12m | -28.34% |

| Growth Correlation 12m | 8% |

| Growth Correlation 3m | -33% |

| CAGR 5y | -25.41% |

| CAGR/Mean DD 5y | -0.47 |

| Sharpe Ratio 12m | -0.34 |

| Alpha vs SP500 12m | -61.62 |

| Beta vs SP500 5y weekly | 1.81 |

| ValueRay RSI | 54.50 |

| Volatility GJR Garch 1y | 86.44% |

| Price / SMA 50 | 2.86% |

| Price / SMA 200 | -15.29% |

| Current Volume | 2882.7k |

| Average Volume 20d | 3092k |

External Links for QRTEA Stock

News

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

What is the price of QRTEA stocks?

As of July 27, 2024, the stock is trading at USD 0.72 with a total of 2,882,691 shares traded.

Over the past week, the price has changed by -5.75%, over one month by +15.94%, over three months by -20.47% and over the past year by -29.75%.

As of July 27, 2024, the stock is trading at USD 0.72 with a total of 2,882,691 shares traded.

Over the past week, the price has changed by -5.75%, over one month by +15.94%, over three months by -20.47% and over the past year by -29.75%.

What are the forecast for QRTEA stock price target?

According to ValueRays Forecast Model, QRTEA Qurate Retail Series A will be worth about 0.7 in July 2025. The stock is currently trading at 0.72. This means that the stock has a potential downside of -8.33%.

According to ValueRays Forecast Model, QRTEA Qurate Retail Series A will be worth about 0.7 in July 2025. The stock is currently trading at 0.72. This means that the stock has a potential downside of -8.33%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 0.9 | 18.1 |

| Analysts Target Price | 0.6 | -23.6 |

| ValueRay Target Price | 0.7 | -8.33 |