Bank of America Corporation: A Comprehensive Overview

History

Bank of America Corporation, known widely as Bank of America, has a rich history that dates back to over a century. Initially founded as the Bank of Italy in San Francisco in 1904 by Amadeo Pietro Giannini, it aimed to serve the financial needs of immigrants whom other banks often overlooked at the time. After years of growth and strategic acquisitions, it eventually became Bank of America. Today, it stands as a testament to innovative banking, inclusion, and expansion.

Core Business

The core business of Bank of America revolves around providing a vast range of banking and financial services. These include consumer banking, which is the heart of its operations, offering services such as checking and savings accounts, credit cards, and mortgages. Additionally, it has a substantial presence in wealth management, investment banking, and commercial banking. Through its Merrill Lynch division, it extends wealth management and brokerage services, while its investment banking prowess is demonstrated through strategic advisory services, capital raising, and risk management.

Side Business

Beyond its primary banking and financial services, Bank of America engages in a variety of side businesses that complement its core operations. These include, but are not limited to, insurance services, investment in renewable energy projects, and philanthropic endeavors through its charitable foundation. These ventures reflect the corporation's commitment to social responsibility and sustainability, aligning with broader economic and environmental goals.

Current Market Status

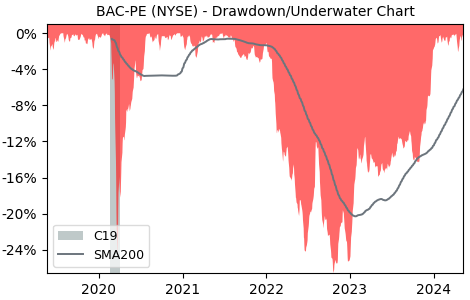

As of the latest update in 2023, Bank of America stands as a leading financial institution not just in the United States, but globally. With a robust financial position, it continues to navigate the complexities of the global economy, adapting to changes and seizing opportunities for growth. Its stock, traded under the ticker NYSE:BAC-PE, reflects its market stability and investor confidence. Despite economic fluctuations and competitive pressures, the corporation remains focused on delivering value to its stakeholders and maintaining its market leadership.