Bank of America Corporation: A Comprehensive Overview

Bank of America Corporation, often abbreviated as BofA, stands as one of the leading global banking and financial institutions. With its roots stretching back to 1904, the corporation has evolved significantly over the decades. It was founded by Amadeo Pietro Giannini as the Bank of Italy in San Francisco, aiming to serve immigrants denied services by other banks. Through a series of strategic merges and acquisitions, notably with NationsBank in 1998, it metamorphosed into the entity now recognized worldwide as Bank of America.

Core Business

At its core, Bank of America provides a wide array of banking and financial products and services. These encompass retail banking, wealth management, commercial banking, and investment banking. The institution serves individual consumers, small and middle-market businesses, and large corporations with a full range of banking, investing, asset management, and other financial and risk management products and services.

Side Business and Innovations

Aside from its core operations, Bank of America actively invests in technology and innovation to enhance customer experience and efficiency. Through its Global Technology & Operations division, the bank focuses on leveraging cutting-edge technology, including artificial intelligence, blockchain, and cloud computing. Moreover, it has embraced digital banking, with a substantial number of consumers using its online and mobile banking platforms, facilitating various transactions and services online.

Current Market Status

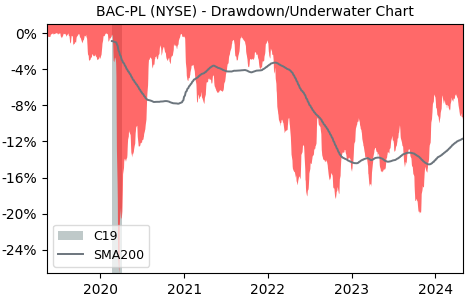

As of now, Bank of America holds a strong position in the financial industry. It's one of the largest banks in the United States by assets and has a significant presence in several international markets. Despite the challenges posed by economic fluctuations and stringent regulatory environments, the corporation has demonstrated resilience and adaptability. It continues to report substantial earnings, attract investments, and maintain a loyal customer base. The stock of Bank of America Corporation (NYSE:BAC-PL) remains a watched and analyzed component in the financial markets, indicative of its influence and importance in the global financial arena.