BML-PG - Bank of America - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Preferred Stock • ISIN: -s

Banking, Investment, Lending, Credit, Debit, Mortgages, Insurance

Bank of America Corporation is a global financial powerhouse that offers a wide range of banking and financial products and services to individuals, small and medium-sized businesses, institutional investors, large corporations, and governments worldwide.

The company operates through four main segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets. The Consumer Banking segment provides traditional banking services, including savings and checking accounts, credit and debit cards, mortgages, and personal loans, as well as investment products and services.

The GWIM segment offers a suite of investment management, brokerage, and banking services, including wealth management solutions, trust and retirement products, and customized asset management services. This segment caters to high-net-worth individuals, families, and institutions, providing them with tailored financial solutions.

The Global Banking segment provides a range of lending products and services, including commercial loans, leases, and trade finance, as well as treasury management, foreign exchange, and working capital management solutions. This segment also offers debt and equity underwriting and distribution, merger-related advisory services, and fixed-income and equity research.

The Global Markets segment is a leading player in the global financial markets, providing market-making, financing, securities clearing, settlement, and custody services. It also offers a range of securities and derivative products, as well as risk management solutions using interest rate, equity, credit, currency, and commodity derivatives.

With a rich history dating back to 1784, Bank of America Corporation is headquartered in Charlotte, North Carolina, and operates a vast network of branches, ATMs, and online platforms, serving millions of customers worldwide. The company's website can be accessed at https://www.bankofamerica.com.

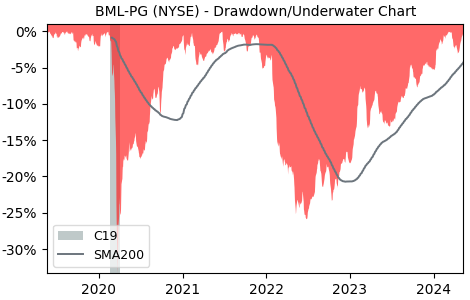

Drawdown (Underwater) Chart

BML-PG Stock Overview

| Market Cap in USD | 309,901m |

| Sector | Financial Services |

| Industry | Banks - Diversified |

| GiC SubIndustry | Regional Banks |

| TER | 0.00% |

| IPO / Inception |

BML-PG Stock Ratings

| Growth 5y | 50.0 |

| Fundamental | 2.57 |

| Dividend | 86.9 |

| Rel. Performance vs Sector | -2.38 |

| Analysts | - |

| Fair Price Momentum | 24.06 USD |

| Fair Price DCF | 119.97 USD |

BML-PG Dividends

| Dividend Yield 12m | 6.96% |

| Yield on Cost 5y | 9.46% |

| Dividends CAGR 5y | 12.68% |

| Payout Consistency | 96.3% |

BML-PG Growth Ratios

| Growth 12m | 20.46% |

| Growth Correlation 12m | 96.2% |

| Growth Correlation 3m | 82.8% |

| CAGR 5y | 6.33% |

| CAGR/Mean DD 5y | 0.77 |

| Sharpe Ratio 12m | 1.61 |

| Alpha vs SP500 12m | -7.30 |

| Beta vs SP500 5y weekly | 0.64 |

| ValueRay RSI | 29.26 |

| Volatility GJR Garch 1y | 9.40% |

| Price / SMA 50 | 0.79% |

| Price / SMA 200 | 5% |

| Current Volume | 9.4k |

| Average Volume 20d | 10.3k |

External Links for BML-PG Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of October 22, 2024, the stock is trading at USD 22.88 with a total of 9,366 shares traded.

Over the past week, the price has changed by +0.00%, over one month by -0.74%, over three months by +4.19% and over the past year by +18.78%.

According to ValueRays Forecast Model, BML-PG Bank of America will be worth about 26 in October 2025. The stock is currently trading at 22.88. This means that the stock has a potential upside of +13.68%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 26 | 13.7 |